Network as a Service (NaaS) PlayBook

The NaaS PlayBook is the vehicle to serve as the planning and implementation guide for RST NaaS initiatives.

The PlayBook aspires to…

The PlayBook will…

The NaaS PlayBook is the vehicle to serve as the planning and implementation guide for RST NaaS initiatives. It consists of Frontend and Backend streams comprised of modules, atomic units built around specific objectives and select content and complemented by methods to encourage engagement relevancy.

1. Strategy and Design

A Strategy & Scope Definition plays a critical role for NaaS operators as it defines the strategic goals as well as the strategic decisions to achieve them.

The Strategy & Scope definition is fundamental in the NaaS operator initiative as it provides a sense of direction and outlines measurable goals. Through an optimal definition of these aspects, the leadership team can ensure alignment on the scope and priorities towards fulfilment of the strategic objectives.

This module guides the NaaS operator through an overview of the Strategy & Scope fundamentals and the imperative of its optimal definition and implementation. Furthermore, it provides an Implementation Process that can be tailored to translate the NaaS operator mission and vision into strategic objectives that can be tracked.

The main outputs of this module are the Strategies Definition for critical aspects of the Naas operator. These strategies direct the decisions on subsequent modules in order to align them with the high-level objectives. Complementary outputs are, among others, the Mission & Scope Definition and the Tracking Methodologies to evaluate the implementation of the defined strategies.

1.1 Module Objectives

This module will enable the NaaS Operator to define the Strategy & Scope of the NaaS initiative. The specific objectives of this module are to:

- Provide procedures to enable NaaS operator to perform a self-assessment analysis based on an examination of the particular environment and market.

- Guide the NaaS operator to clarify the high-level scope by defining its own tailored mission and service definition.

- Instruct the NaaS operator in the strategy and long-term objectives definition to guide decisions in downstream activities.

- Provide methodologies to control and manage the defined strategies implementation and updates.

1.2 Module Framework

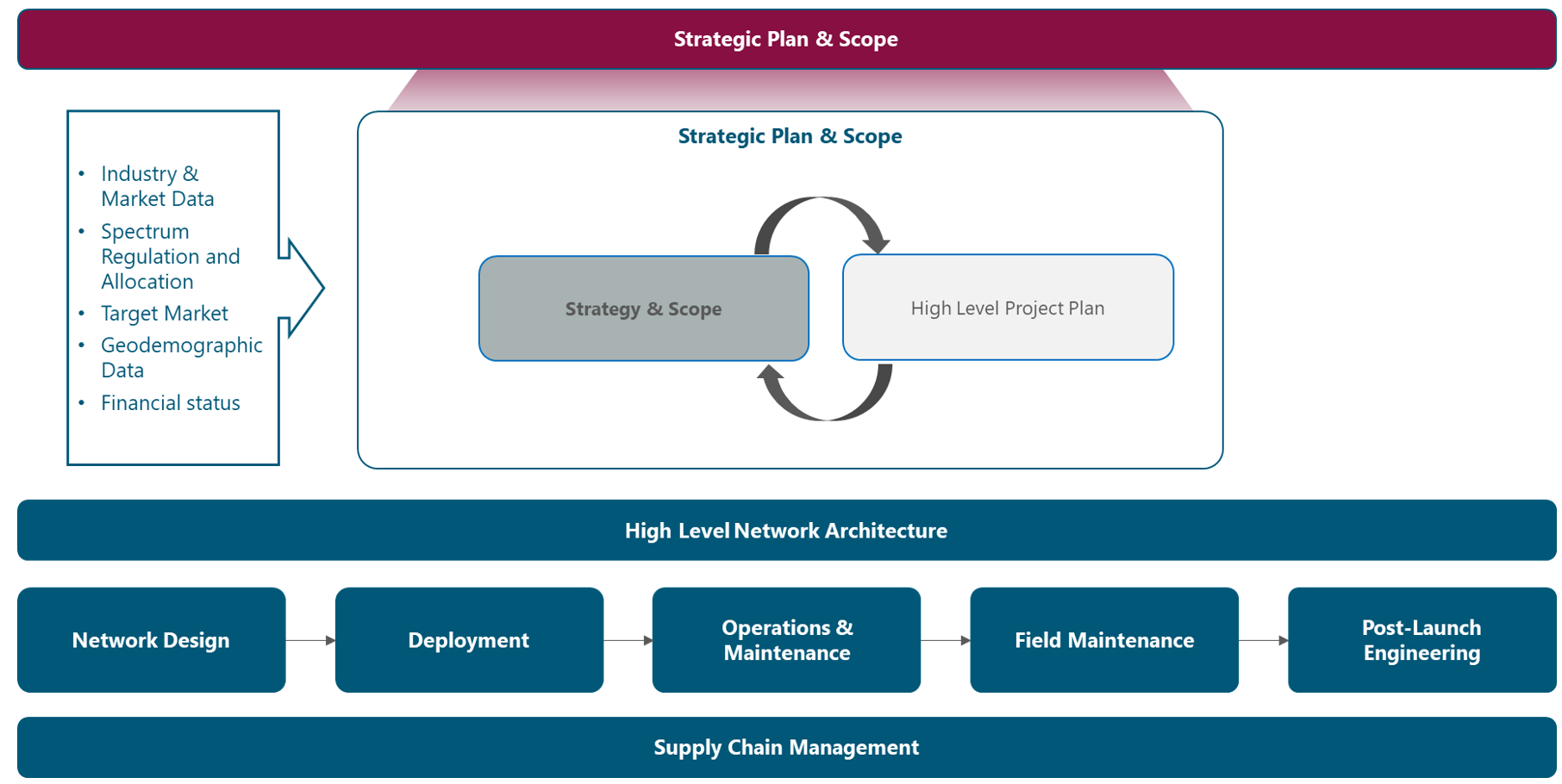

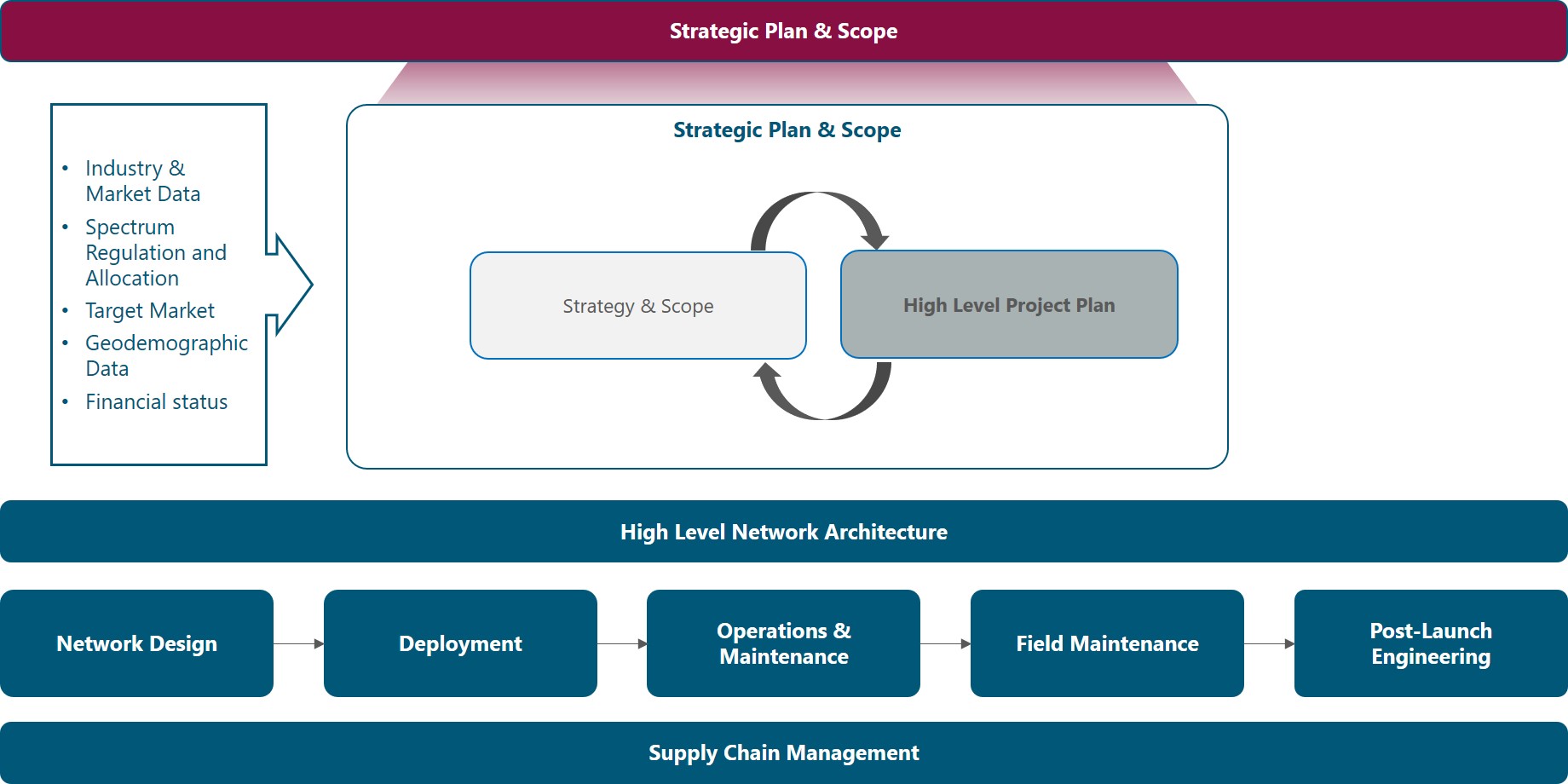

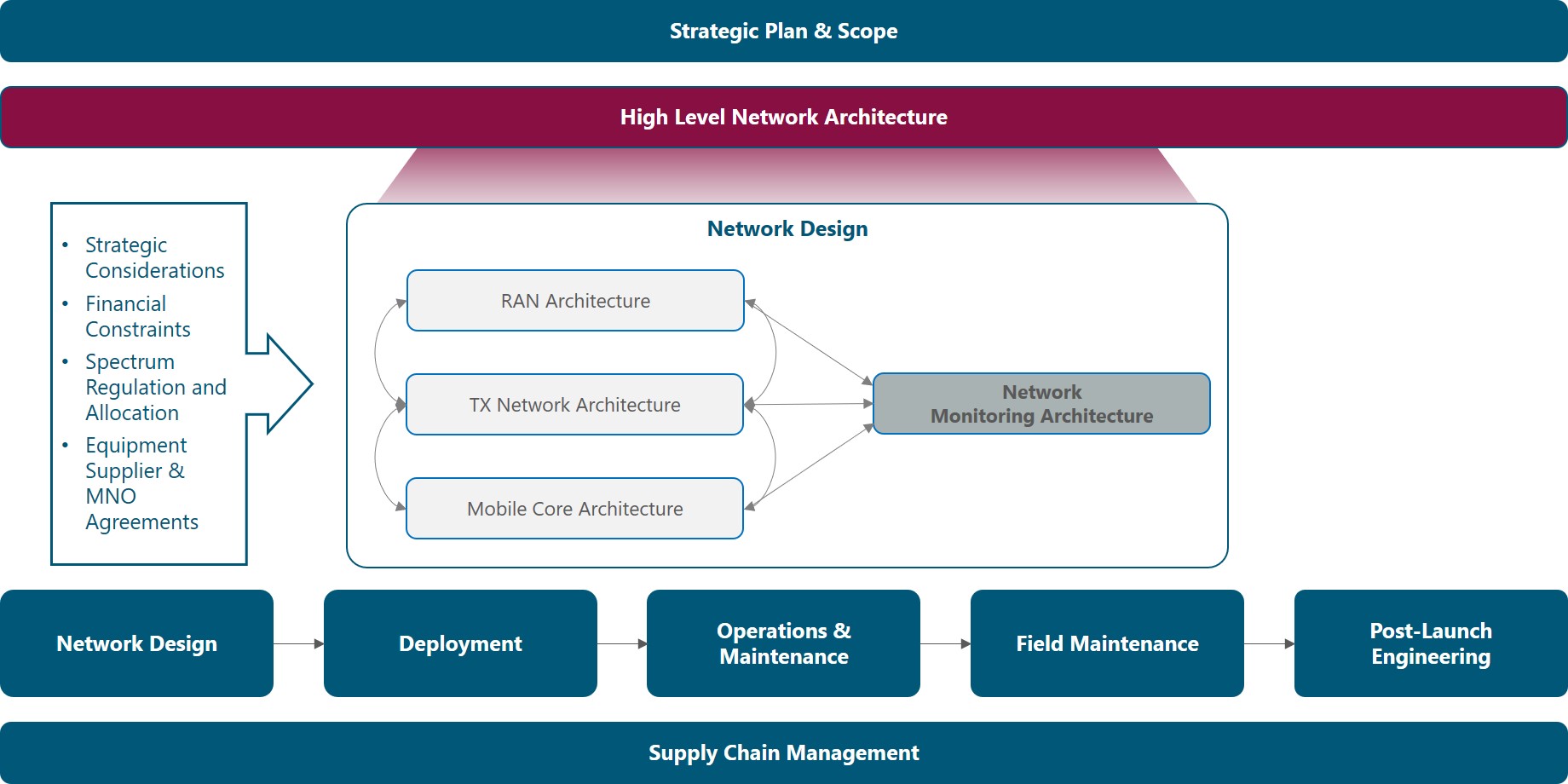

The Module Framework in Figure 1 describes the structure, interactions and dependencies among different NaaS operator areas.

Strategic Plan & Scope is the first stream to build the NaaS operator. The modules in this stream aim to drive strategic decisions that impact all the downstream streams and modules. From this point, High Level Network Architecture can be defined establishing the guidelines for Network Design which in turn kick-starts the deployment phase.

Figure 1. Module Framework

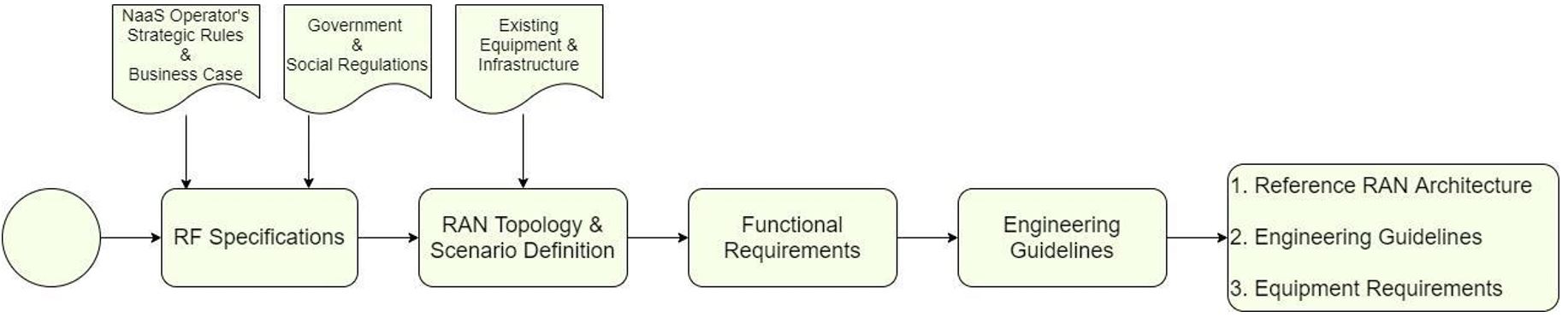

Figure 2 presents the Strategy & Scope process view where the main functional components are exhibited. Critical module inputs are further described and examined.

Figure 2. Module Process View

The rest of the module is divided into five sections. Section 2 is a birds-eye view of the Strategy & Scope Fundamentals as well as a high-level view of their development process. Section 3 focuses on the procedures to examine the particular environment and market. Section 4 describes processes to define the NaaS operators mission and scope. Then in section 5, methodologies to generate the overall strategies and long-term objectives are provided. Finally, Section 6 includes procedures to control and manage the implementation and updates of the defined strategies.

2. Strategy & Scope Fundamentals

This section presents a general overview of the baseline concepts to develop the NaaS Initiative Strategy & Scope.

2.1 Strategy & Scope Imperative

The Strategy & Scope of the NaaS operator is the process of an organization deciding their corporate direction, objectives and priorities, and then aligning their resources to accomplish the actions necessary to meet them.

The main outcome of the Strategy & Scope module is the Strategy definition around certain critical areas within the NaaS operator. The Strategies will guide the decision of subsequent phases (e.g. Network Design and Deployment). This means that the Network Design and Deployment streams use the strategic decisions of this module to generate its own processes. For this reason, Strategy & Scope is the first step to build the NaaS operator.

Additional outputs from this module are Organization Strategies and Long-Term Strategic Objectives. These outputs are the starting point and provide a general guide for the High-Level Project Plan, which aims to answer how the Strategy and Objectives will be achieved and who must do what to accomplish them.

Finally, as stated before, the Strategy & Scope module establishes the direction of the NaaS operator, including the financial resources, so it maintains a relationship with the Financial Plan. In other words, the Financial Plan outlines the allocation of financial resources to reach the broad goals set out in strategic planning. However, the Financial Plan is out of the scope of this module.

2.2 Process Overview

Figure 3 displays the process to develop the Strategy & Scope Definition for NaaS operators in a logical and well-structured sequence. It offers a roadmap for functional leaders that must identify and prioritize initiatives at a functional level.

Figure 3. Strategy & Scope Definition Process

The first step, Research & Analysis, provides the methodologies to analyze the conditions of different environments that the NaaS operator is subject to. This information can be collected via web research on the operating environment and telecom-industry environment reports. The survey application on customers is also a common practice. The primary outcome of this process is the SWOT analysis.

The next step, Mission and Scope, addresses the what (mission) and where does the NaaS operator want to be in the long term (vision) of the NaaS operator. The definition of these elements is an essential part to building the strategic foundation and developing a strategy. Based on these elements, the competitive advantages can be identified. An additional step for the NaaS operator, is to define the technologies and services that will be part of its catalog.

The Strategy Design step contains the methodologies to develop the strategies around different NaaS operator areas. These strategies guide the decisions on subsequent modules. Furthermore, it provides the methods to transform these strategies into realistic goals.

Finally, the Governance step provides guidance to move a strategic plan from a document that sits on the shelf to actions that drive organizational growth.

3 Research & Analysis

This section aims to describe procedures to examine the particular NaaS operator environment and market.

3.1 Strategic Issues & Risk Identification

Strategic issues are critical unknowns that need to be resolved by the strategic planning process. These issues can be problems, opportunities, market shifts or anything else requiring special consideration by the NaaS operator.

Strategic issues are developed and identified based on input from the leadership team. These issues should be a summary of critical topics that need to be addressed during the planning process. The idea is to call these issues out early, so the important areas are not lost among a lot of data, details, and ideas.

In the NaaS operator context, some strategic issues can be:

After identifying the Strategic Issues, they need to be recorded into the Strategy & Scope Definition Template as they will be used for the Strategies definition.

3.2 Operating Environmental Scan

The environmental conditions have a significant impact on the direction of the NaaS operator. Since the environment is prone to continuous changes, the organizations that are not aware of their business environments are likely to fail.

The environmental scan is the process of identifying, collecting and evaluating information about elements that are external influences on the NaaS operator. This process helps in a greater understanding of environmental changes and guides decisions on the NaaS operators strategic direction.

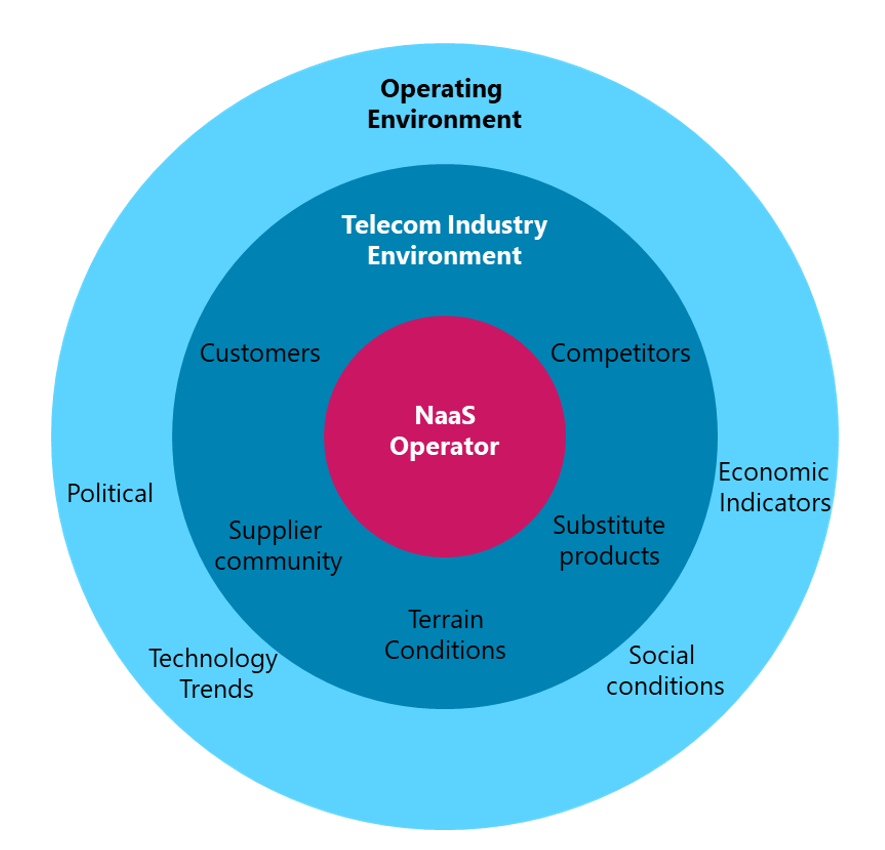

The environmental factors impacting the strategic planning can be grouped into two broad categories: the Operating Environment and the Telecom Industry Environment as shown in Figure 4. This section focuses on analyzing the distinct aspects regarding the Operational Environment.

Figure 4. Environment Factors Diagram

More details regarding the specific elements within each category in Figure 4 are provided in the following subsections.

The operating environment, which indirectly affects the NaaS operator comprises Political, Economic, Social and Technological factors. Thus, the operating environment scan is also named as PEST analysis and is part of the Strategy & Scope process. The result of the Operating Environment Scan must be recorded into the Strategy & Scope Definition Template as it will be used on the SWOT Analysis.

Political (includes legal and regulatory)

Includes the political-legal factors comprising the countrys laws and regulations that can influence the NaaS operator objectives and operations.

Economic

The role of economic factors is important in the context of the telecom industry. NaaS operators should account for the national economy, including inflation rates, interest rates, and most importantly, disposable income.

Social

Social factors have a profound influence on the telecommunications industry and its profitability. This is because it has a direct impact on the number and type of services demanded by users.

Technological

The telecommunications industry is highly dependent on technology changes. The NaaS operator should gain most of these technological trends.

3.3 Telecom Industry Environment Scan

As shown in Figure 4, the NaaS operator must be aware of the Telecom Industry Environment. This section provides general guidelines to collect information about customers, competitors, and other market variables to generate insights for strategies definition.

3.3.1 Telecom Conditions Evaluation

Suppliers Environment

A part of the Environmental Analysis is the evaluation of the available suppliers and their effect on the environment. The NaaS operator suppliers environment is mainly composed of the following elements:

The information regarding suppliers environment can be collected by performing a research on the web sites of the different suppliers.

Geographic Conditions

An analysis regarding the terrain conditions must be conducted, especially in rural areas. The specific geographic features (e.g. mountains, dense forest) may significantly complicate the network deployment for remote populations as the access to the site for construction and maintenance may complicate. Furthermore, harsh climates (e.g. extreme hot or cold) can make the operation and maintenance tasks of the site more challenging.

This analysis has a direct impact on the subsequent design and deployment phases as often extensive microwave or fiber optic laying must be required in the transport network. If the terrestrial solutions are not feasible, NaaS operators often have to rely on satellite transport with additional expensive bandwidth fees to connect remote areas.

In addition to the terrain, the climate can also have a significant impact on the satellite signals as these are vulnerable to rain conditions that can occur regularly in tropical areas.

In further deployment phases, it is important to perform a Technical Site Survey (TSS) on each site to clearly define the geographic conditions.

Basic Infrastructure

The network deployment in rural and remote locations is directly impacted by a lack of basic infrastructure (e.g. power grid, road access). If adverse conditions are presented, the Naas operator must build each site in a self-sufficient manner (e.g. solar energy-based). This represents an increment in the deployment costs and subsequent operations and maintenance costs.

Furthermore, the quality of the basic infrastructure must be identified as bad quality infrastructure may represents additional costs on the site operations (e.g. bad quality power grid may require backup batteries).

The Technical Site Survey (TSS) on each site in further deployment phases clearly defines the existing basic infrastructure conditions.

3.3.2 Customer Segmentation and Targeting

The NaaS operator should recognize that all customers have to be approached in different ways as their needs and values are different. Rather than trying to compete in the entire market, the NaaS operator must identify parts of the market that can be served best and most profitably.

The most effective way to achieve this is to segment customers. The goal of creating customer segments is so that specific customers that have similar needs can be targeted with the same products and pricing.

The following questions can help to identify the target Customer Segments:

In the context of NaaS operator environment, the potential customers are:

Once segments are identified, the NaaS operator must determine its particular needs and the most appropriate way to satisfy them by providing value. The following process illustrates the process to perform customer segmentation.

- Segment Name: Establish a name for the target customer segment.

- Evaluate: After the customer segments have been identified, evaluate them based on the following criteria:

- Identify Customer Needs: List the needs or wants of this customer segment. Target customer segments can be grouped based on similar needs, motivation, or behavior.

- Identify Customer Characteristics: List the characteristics that describe this segment. The major categories of characteristics are: demographic, geographic and usage.

- Customer Profile Development: Create a customer profile that uniquely describes this target customer segment.

In the context of NaaS operator environment, some alternatives of customer segment definition are:

3.3.3 Competitive Analysis

The competitive analysis aims to assess the opportunities and threats that may occur from those organizations competing for the same business. The NaaS operator needs to have an understanding of what competitors are or arent offering the same service to potential customers.

Unless explicitly stated, along this document the term customer refers to entities that buy services directly from the NaaS operator (e.g. MNOs, MVNOs). In contrast, end-user term refers to subscribers that use the LTE services. It is important to mention that not all the end-users buy services directly from the NaaS operator, as some of them will buy the service from an MVNO.

In order to identify the organizations that compete for the same customers, the following actions must be performed:

The following subsections examine different types of organizations that compete for the same group of customers as NaaS operators. They can be divided into two main groups: Direct competitors and Substitute Products.

Direct Competitors

In the NaaS operator context, the direct competitors are:

Substitute Products

A substitute product performs the same or a similar function as the NaaS operator offer but by different means. Substitutes offer the greatest threat when they can provide customers with better service at lower costs through changes that improve the value of their products or services.

In the NaaS operator context, the main substitute products can be in the form of:

In order to quantify the specific threat of substitute products, it is essential to look at the price-performance trade-off between the substitute and the NaaS operator services.

3.4 SWOT Analysis

This section presents a Methodology to develop a SWOT (Strengths, Weaknesses, Opportunities, and Threats) Analysis to evaluate the NaaS operators strategic position.

3.4.1 Identify Opportunities and Threats

Opportunities are situations that potentially exist but must be acted on so to benefit the NaaS operator. Most relevant opportunities are those that offer important avenues for profitable growth, those where a company has the most potential for competitive development, and those that match up well with the financial and organizational resource capabilities that the company already possesses or can acquire.

In contrast, Threats refer to external conditions or barriers that may prevent the NaaS operator from reaching its objectives.

The areas presented in Table 1 can help to identify opportunities and threats that can be identified using the results of the Operating and Telecom Industry Environmental Scan.

|

Area |

Potential opportunities and threats |

|

Operating Environment |

– Political/Legal – Environment – Social – Technological |

|

Telecom Industry |

– New competitors – Substitute products – Competitive rivalry |

|

Competitors |

– Identified competitors – Strengths, weaknesses |

Table 1. Areas of potential Opportunities and Threats

3.4.2 Identify Strengths and Weaknesses

Strengths refer to the areas (e.g., operations, management, marketing) in which the NaaS operator performs successfully. An analysis of organization strengths should be market and customer-focused because strengths are only meaningful when they assist in meeting customer needs. Strengths give the organization enhanced competitiveness.

On the other hand, Weaknesses refer to any limitations that the NaaS operator faces in developing or implementing a Strategy. A weakness is something an organization lacks or does poorly in comparison to others, or a condition that puts it at a disadvantage. Weaknesses should also be examined from a customer perspective because customers often perceive weaknesses that an organization cannot see.

The strengths and weaknesses can be discovered via brainstorming process among the elements of the leadership team and by breaking them down in the areas presented in Table 2.

|

Area |

Potential strengths and weaknesses |

|

Capabilities |

– Human – Organizational – Knowledge |

|

Resources |

– Financial – Physical – Intangible |

|

Processes |

– Deployment – Operational – Customer management |

Table 2. Areas of potential Strengths and Weaknesses.

3.4.3 SWOT Development

A SWOT analysis is a methodology to examine an organization by looking at the internal strengths and weaknesses in relation to external opportunities and threats. This analysis takes as an input all the previous analysis (i.e. Operating and Telecom Industry Environmental Scan, Customer Segmentation, Competitive Analysis). By creating a SWOT analysis, all the important factors affecting the organization can be seen together in one place. Its easy to read, easy to communicate, and easy to create.

The following list considers some questions to be asked during the development of the SWOT. These questions should have been already answered in the analysis prior to the SWOT development:

Once the SWOT Analysis is completed, the information should be used to start the development of strategies that will leverage the NaaS operators strengths to pursue opportunities, while also countering identified weaknesses and threats that might undermine its efforts. The SWOT analysis is a crucial input to develop strategic alternatives and potential goals.

Additionally, the Naas operator can use the SWOT Analysis Template to support the SWOT Analysis development.

4 Mission and Scope

The content of this section illustrates the procedures to establish a charter by defining the particular mission, vision and service definition for the NaaS Initiative.

4.1 Mission Statement Development

The mission statement is a declaration of the NaaS operators purpose and spotlights the customer needs that are endeavoring to be met. To build a solid foundation for a successful organization, it is essential to have a written, clear, concise, and consistent mission statement that simply explains the NaaS operators purpose.

The mission statement should serve as a guide for day-to-day operations and as the foundation for future decision-making. The following guidelines should be considered when writing or evaluating the mission statement:

Additionally, the Naas operator can use the Mission Statement Assessment Checklist to assess the above criteria on the developed mission statement.

4.2 Vision Statement Development

The vision statement provides a clear mental picture of what will the NaaS operator look like in 5 to 10 years from now. Forming a strategic vision should provide long-term direction, delineate the organizational activities to be pursued and the capabilities the NaaS operator plans to develop. It serves as a unifying focal point for everyone in the Organization.

An effective vision statement consists of the following elements. The specific vision statement generated by the NaaS operator may nor incorporate all these elements, but they must be considered when casting the statement:

4.3 Identify Competitive Advantages

The competitive advantage is what the NaaS operator does or potentially could do better than similar organizations. One result of a well-developed and executed strategic plan is to develop a unique competitive advantage. A sustainable competitive advantage(s) is the foundation, the cornerstone of the strategy.

The following criteria must be considered to evaluate the Competitive Advantage identification:

Some examples of competitive advantage in the NaaS operator context are:

4.4 Technologies and Services Definition

This section examines different technologies and services that can be included as part of the catalog to be offered to customers.

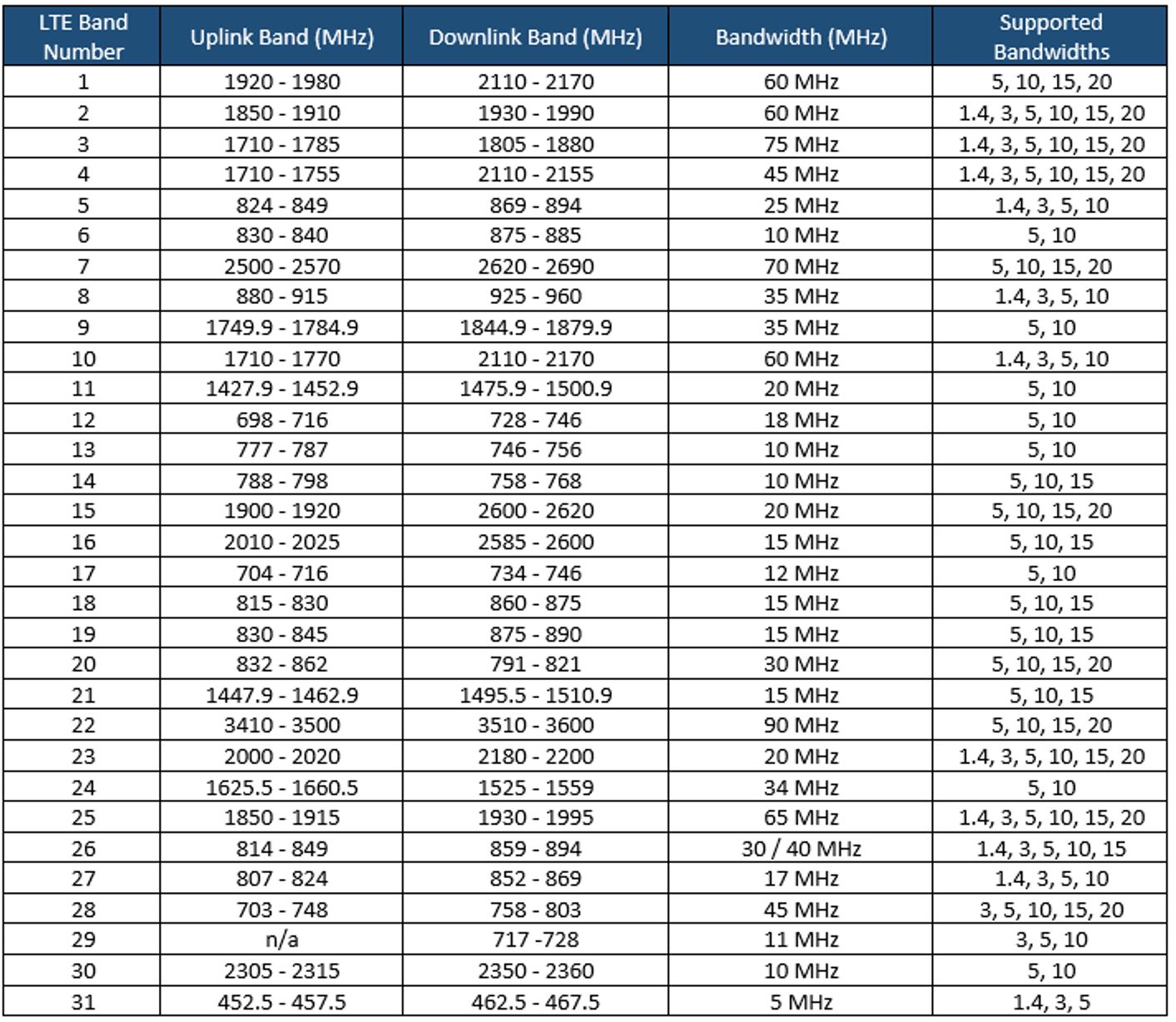

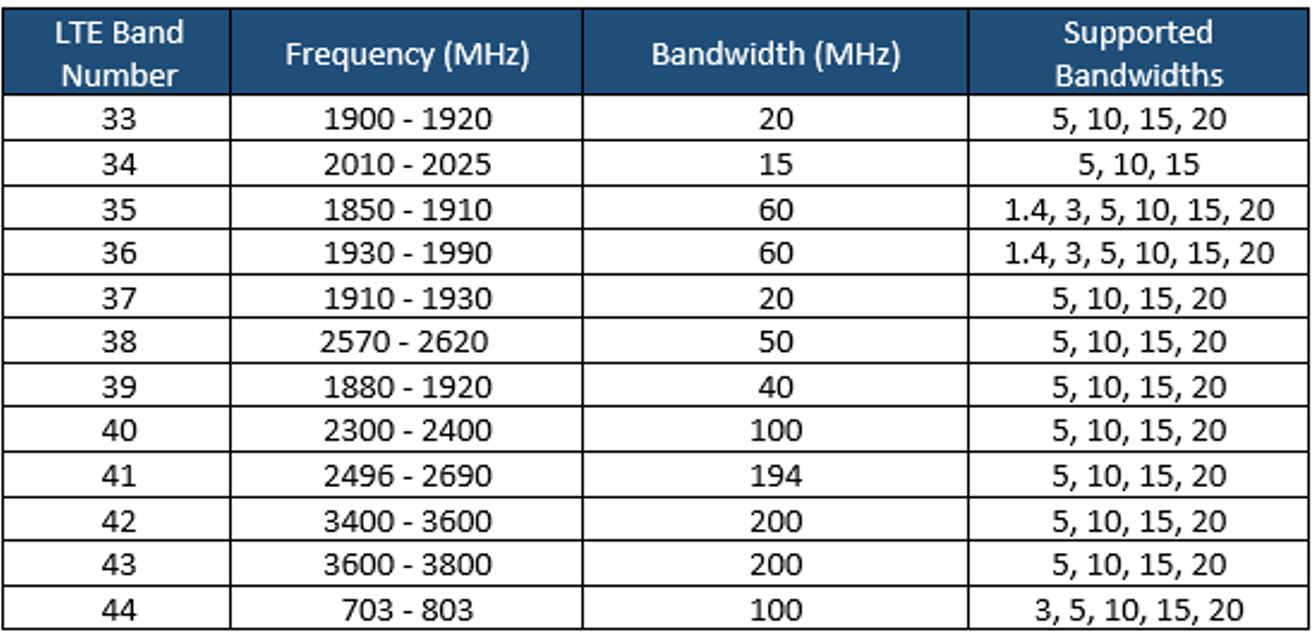

4.4.1 Radio Technologies

4G Long-Term Evolution (LTE)

4G LTE is a wireless communications standard developed by the 3rd Generation Partnership Project (3GPP) and it is reflective of the coverage consumers now expect. LTE delivers the ability to use end devices to their peak functionality.

The recommendation is that LTE must always be the default technology to be deployed by NaaS operators.

Pre-Existing 3G (UMTS) / 2G (GSM) Network

The rural areas may have coverage with legacy technologies (e.g. 3G UMTS and 2G GSM) provided by some existing MNOs. However, these technologies are not capable of supporting todays user requirements.

It is not recommended to deploy 3G equipment as the use of this technology will be declining in the coming years. However, in case of deployment of 3G equipment, the NaaS operator must ensure that it can be depreciated while still being used.

The recommendation is that 3G and 2G technologies should not be deployed and only be considered for CS Fallback capabilities.

5G Radio Technology

The fifth-generation (5G) of cellular technology increases the speed and responsiveness of wireless networks. Over this network, data can be transmitted at multi-gigabit speeds, with potential peaks of 20Gbps. Moreover, it offers a latency of 1ms that enable real-time applications. 5G will also increase the available bandwidth due to advance antenna technology implementation.

Despite all the advertised capabilities, 5G deployments have not been massively implemented as the technology and equipment standards are still in process of development.

The recommendation is that 5G radio technology should not be deployed in the NaaS operator network until successful tests are successfully completed in NaaS operator laboratories or flagship rural deployments.

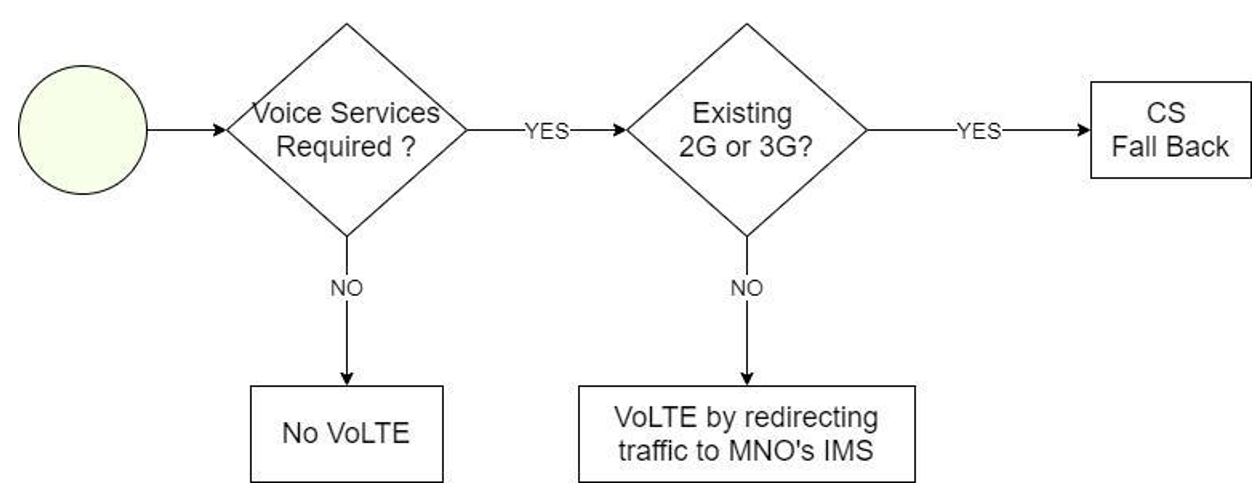

4.4.2 Voice Services

The NaaS operator must evaluate if Voice Services will be part of its catalog of services as it represents special considerations in the network architecture. It can select to only provide data services for their customers.

If the NaaS operator wants to offer voice services as part of its catalog service, there are three available options that are described in the following subsections. Further details on the implementation of these alternatives are provided in the Mobile Core Architecture module.

Circuit Switched FallBack (CSFB)

In this scenario, the LTE handset falls back to 3G or 2G to establish a traditional circuit switching connection. As CSFB is not strictly an LTE based voice service, rather EPC assists the device to fall back to a 2G/3G network. It presents many drawbacks such as, higher call-setup-delay or just acceptable quality voice.

However, if the NaaS operator has a pre-existing 2G/3G network then the CSFB functionality must always be deployed for simplicity.

Voice over internet protocol (VoIP) / Over the top (OTT) Application

VoIP is the transmission of voice and multimedia content over Internet Protocol (IP) networks. This service is also referred as Over-the-top (OTT) Application and PoC (Push-to-Talk over Cellular). These type of applications can be free (e.g. WhatsApp, Facebook) or be provided by the VoIP service provider.

VoIP is the recommended alternative when the NaaS operator wants to provide voice services through its 4G-only network and has budget limitations. However, it should be noted that the voice quality will never match VoLTE.

Voice over LTE (VoLTE)

VoLTE is the industry-recognized solution for providing a packet voice service over IP via LTE access technology. When the NaaS operator has the economical/knowledge capabilities and agreements with an IMS network provider, then the option that will deliver HD voice is VoLTE.

Furthermore, NaaS operators should consider the availability of VoLTE-capable devices on its market and the feasibility of VoLTE business case with its customers. Additionally, the customer (e.g. MNO) need to support VoLTE.

5 Strategy Design

The present section describes the definition of the strategy and long-term objectives that ultimately will guide the downstream activities.

5.1 Organization-Wide Strategies Definition

An organization-wide strategy is a general statement(s) that guides and covers a set of activities. It answers the question how. By consistently executing an organization-wide strategy, the NaaS operator can provide a product or service thats better than its competition.

In this step of the planning process, the synthesized information in the SWOT analysis, the mission, vision and competitive advantages are used to develop the organization-wide strategy or strategies that will guide goal and action planning.

The following elements summarize the core of strategy and should be accomplished in the definition of an organization-wide strategy:

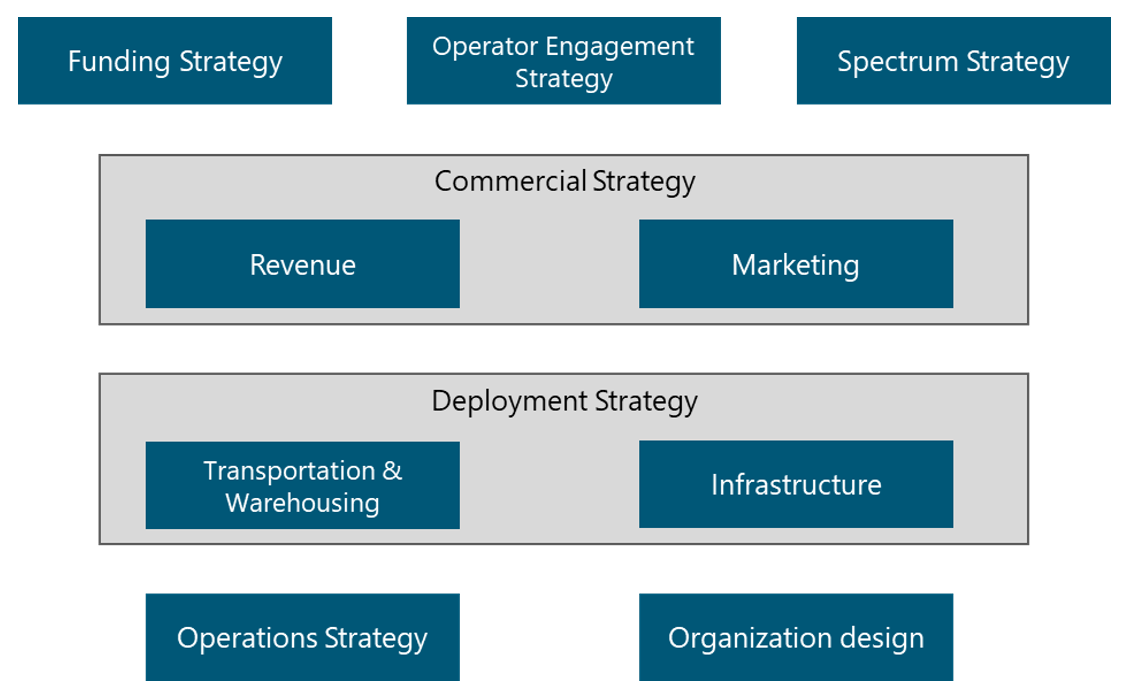

There are certain areas within the NaaS operator that require the definition of a strategy that guides the decision of subsequent phases. These areas are presented in Figure 5 and are examined in the following subsections.

Figure 5. Strategy Map

Additionally, the Naas operator can use the Strategy & Scope Definition Template to support the definition of their own strategies.

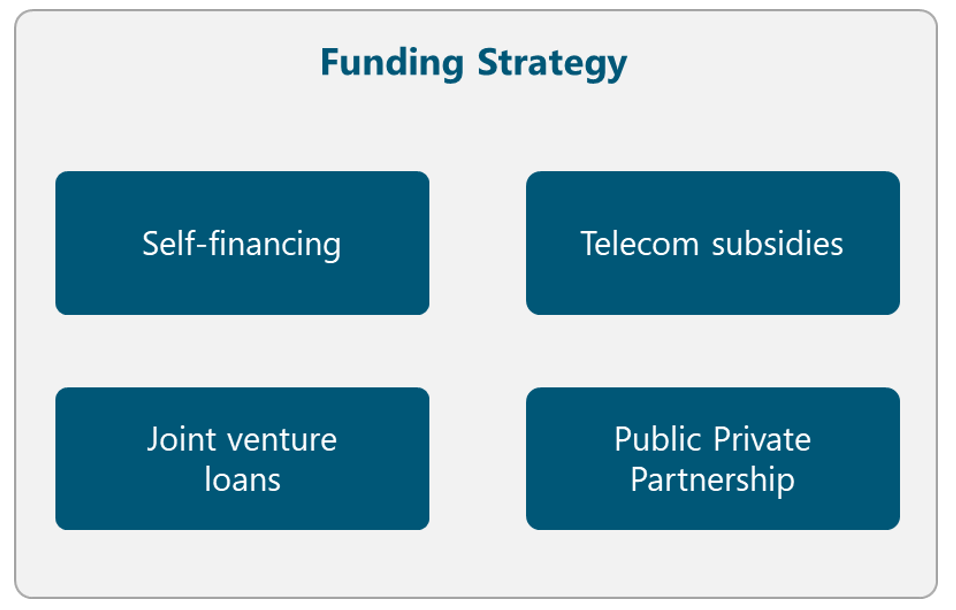

5.1.1 Funding Strategy

A primary element to develop a telecommunication network is to identify the funding methods to deploy the network. There are different strategies for funding telecommunication projects that are presented in Figure 6. NaaS operators must evaluate which of them will be used to fund the initiative. The final decision must consider, among other elements, the applicable political and regulatory conditions and it must be recorded in the Strategy & Scope Definition Template.

Figure 6. Funding Strategy Alternatives

In the following subsections, multiple alternatives that can be used in different countries around the world are presented.

Self-financing

Most of the time, self-financing method is only applicable when the NaaS operator already has an existing network in the country. In this way, the costs of infrastructure can be reduced as existing towers and fiber can be used to support the deployment of the 4G network. Furthermore, the profits from the existing network can be used to build out the new network deployment.

In case that the cost of deployment exceeds the NaaS operators financial capabilities, an alternative method must be evaluated.

Telecom subsidies

An alternative option is to apply for telecom subsidies in the region. A definition of a subsidy is a grant or a monetary gift, usually given from the government to a specific project. Another form of subsidies is that the government reduces the taxes for a company that needs assistance; thereby they get more financial resources.

Joint venture loans

Joint venture loans are an option when the loan for the investment cannot be covered for one single company. This means that two or more companies share the risks and benefits of the loan.

Joint ventures can result in an effective partnership, but to make this happen, they must be structured. To ensure this, it is recommended that an independent president is chosen.

A joint venture often ends when the predetermined goal has been reached (e.g. the deployment completion) so all involved parties need to be prepared for that.

Public-Private Partnership

This partnership means that the private and public sectors share the risk for the project. If there is any risk that they together cannot control, the public sector usually takes responsibility for that risk.

Principally a public-private partnership is a form of privatization, but with a big difference that the public sector is also involved. The partnership is involving the government and one or more private sector companies.

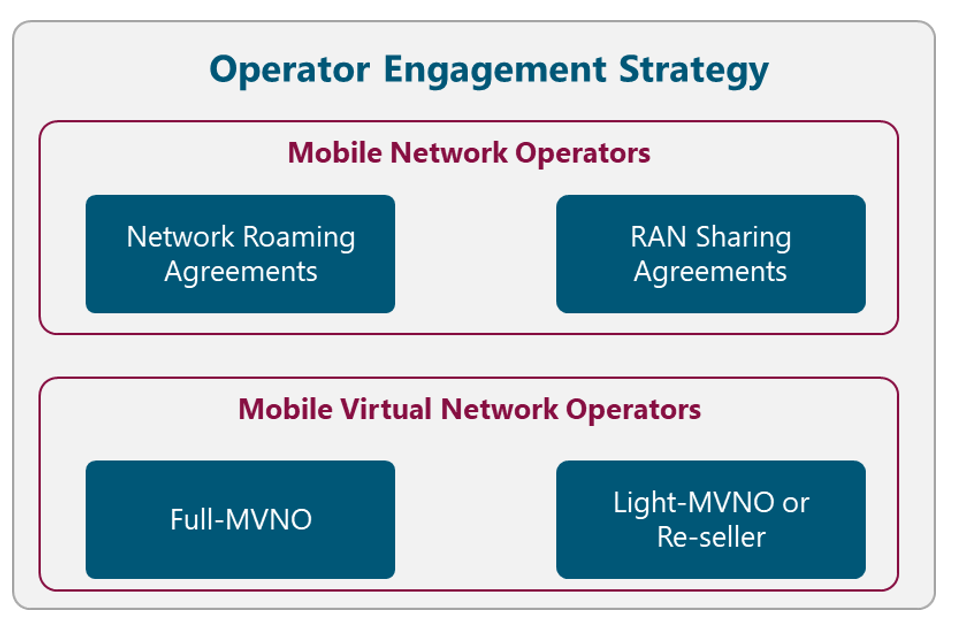

5.1.2 Operator Engagement Strategy

The traditional approach of network deployment, where each operator builds its own network infrastructure is not efficient in rural markets with low population density. In turn, the NaaS operator must analyze ways to co-operate with other operators on expanding network coverage whilst preserving healthy competition in service provision. In this way, an MNO can become a partner for the NaaS operator.

The Operator Engagement has multiple dimensions in the sense that include elements of the Spectrum, Commercial and Infrastructure Strategies. These elements are examined in its corresponding section, but the final definitions must be consolidated in an Operator Engagement Package in order to present them to the operators.

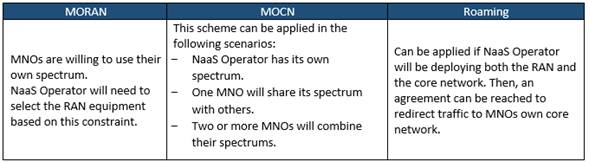

Figure 7 illustrates different alternatives to perform the Operator Engagement. The NaaS operator must evaluate them and select the most appropriate according to its conditions. The final decision must be recorded in the Strategy & Scope Definition Template.

Figure 7. Operator Engagement Strategy Alternatives

The following subsections describe the way to engage different types of operators as well as their impact on the NaaS operator strategy. It must be noted that the decision of the operators to be considered to interconnect with, has a direct impact on the RAN and Mobile Core implementation.

5.1.2.1 Mobile Network Operators (MNO)

The primary driver that an existing Mobile Network Operator can consider to set an agreement with the NaaS operator is to extend its coverage to rural scenarios. For this, the scenarios in the following subsections can be implemented.

The impact on the NaaS operators Radio Access Network and Mobile Core implementation are further detailed in the respective Architecture Modules.

Network Roaming Agreements

In this scenario, NaaS Operator owns the RAN and the core network and redirects the traffic to MNOs core networks. Additionally, the user might have to enable roaming on their phone to access the NaaS network.

This scenario for the NaaS operator implies that a complete RAN and transport infrastructure must be deployed using its own spectrum. Additionally, the Mobile Core must also be implemented along with the interconnection to MNOs Mobile Core.

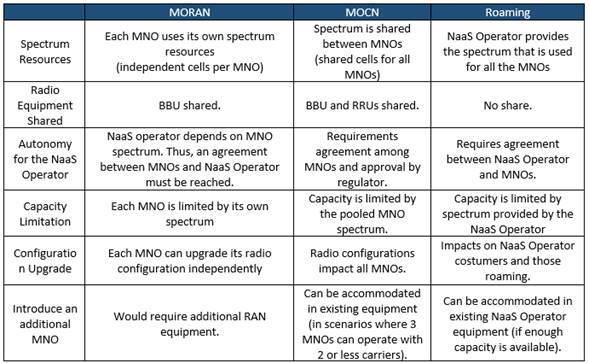

RAN Sharing Agreements

NaaS Operator can provide its RAN infrastructure to multiple MNOs based on different RAN Sharing schemes (e.g. Multi-Operator RAN, Multi-Operator Core Network). In this scenario, a pool of radio spectrum is formed using the available sources (e.g. NaaS operator, MNO). In addition, MNOs rely on the NaaS radio/transport infrastructure to provide service to the end user.

This scenario for the NaaS operator implies that a complete RAN and transport infrastructure must be deployed and its radio spectrum (if existing) can be used to conform the pool of spectrum.

5.1.2.2 Mobile Virtual Network Operator (MVNO)

A Mobile Virtual Network Operator (MVNO) is a virtual operator that offers mobile services under its trademark by using network services from a third-party mobile operator. The MVNOs can be further classified in different categories according to their characteristics.

The impact on the NaaS operators Mobile Core implementation are further detailed in the Architecture Module.

Full-MVNO

In this scenario, the NaaS operator just provides the access network infrastructure and, sometimes, part of the core network. Therefore, the MVNO must build and maintain its own Mobile Core. As a result, the MVNO manages its own customer base and associated services independently from the host operator.

This scenario for the NaaS operator implies that a complete RAN and transport infrastructure must be deployed. In addition, the NaaS operator must possess granted radio spectrum. Finally, the interconnection to MNOs Mobile Core needs to be implemented.

Light-MVNO or Re-seller

The MVNO just provides its brand and its distribution channels. In contrast, the NaaS operator provides the access and transport, as well as the mobile service. This is the model that requires the lowest investment from the MVNO, therefore the fastest to implement.

A Light-MVNO delegates the networks operational management to its host operator, in order to focus on customer relations.

This scenario for the NaaS operator implies that a complete RAN and transport infrastructure must be deployed. . In addition, the NaaS operator must possess granted radio spectrum. Finally, a complete Mobile Core must also be implemented.

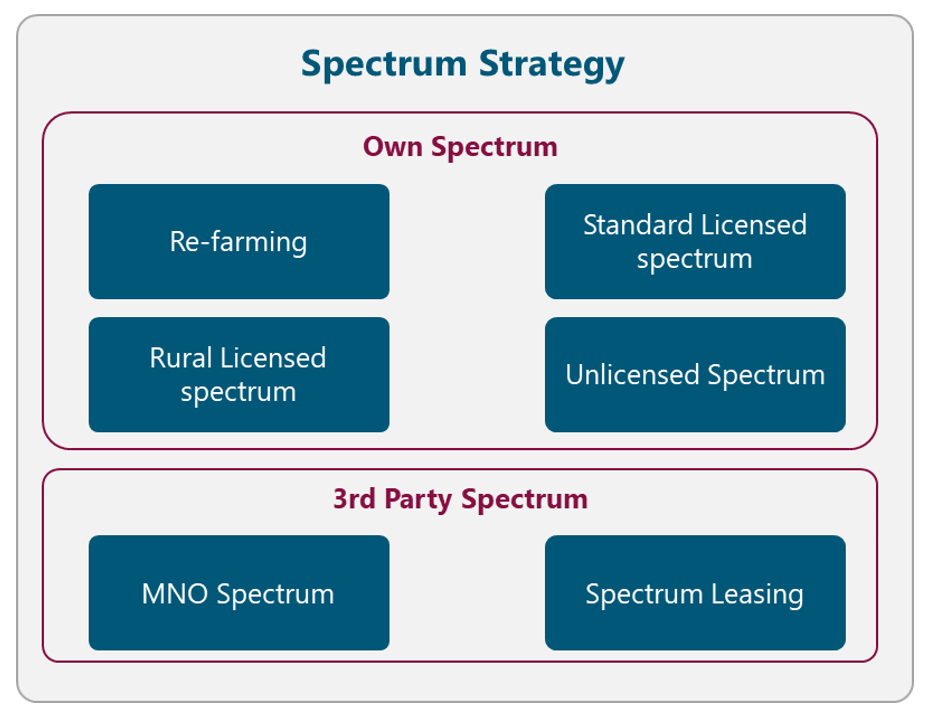

5.1.3 Spectrum Strategy

Efficient spectrum management has an important impact on the quality and reach of affordable mobile services. Figure 8 displays the different alternatives to obtain and manage the radio spectrum.The NaaS operator must evaluate each alternative and select the most appropriate according to its conditions. The final decision must be recorded in the Strategy & Scope Definition Template.

Figure 8. Spectrum Strategy Alternatives

The following subsections examine different approaches to obtain and manage the radio spectrum.

It should be noted that a spectrum license should also be considered for transport microwave equipment. However, microwave spectrum considerations are deeply analyzed in the Transport & IP Architecture module.

5.1.3.1 Own Spectrum

The first alternative is that the NaaS operator manages and operates its own granted spectrum. The following subsections examine different alternatives to achieve this.

Re-farming

If the NaaS operator has an existing operating mobile network, it can use the already licensed spectrum to deploy LTE services. Existing low-frequency spectrum (e.g. 900MHz) used for 2G/3G services can be more effectively reused for 4G service deployment.

Spectrum re-farming is a cost-effective way to increase capacity in existing networks without the need to bid for new spectrum and by reutilizing infrastructure to overlay LTE.

Standard Licensed spectrum

The NaaS operator can follow the standard licensed mechanisms to acquire sufficient spectrum to provide broadband mobile services.

However, the cost of the spectrum fee may impact the overall business case. Additionally, the process of acquiring spectrum is highly time-consuming given its complexity.

Rural Licensed spectrum

Spectrum regulators have been encouraged to clear the 700 MHz and 800 MHz spectrum through the migration to digital television, which can release the so-called digital dividend spectrum for use by mobile services, especially in rural areas.

Furthermore, in some countries, the local government provides specific telecom subsidies and grants to these types of radio bands in order to promote the coverage expansion in rural areas. The NaaS operator can analyze its applicability to these special programs.

Unlicensed Spectrum

The utilization of unlicensed spectrum in the 5GHz range allows an operator to deploy LTE services without the necessity of a license for spectrum. However, the use of unlicensed spectrum imposes transmission power limitations, which limits the coverage area.

In addition, the NaaS Operator needs to verify if other operations are using unlicensed spectrum in the area, as this may cause a considerable amount of interference.

The NaaS Operator must be aware that the operation of LTE in unlicensed spectrum may not be supported by all user devices.

5.1.3.2 3rd Party Spectrum

NaaS operators can use a 3rd party spectrum assigned to provide LTE services. The following subsections examine different options to accomplish this.

MNO Spectrum

NaaS Operators can use the MNO granted spectrum to provide LTE services via different RAN Sharing schemes (e.g. Multi-Operator RAN, Multi-Operator Core Network). In this scenario, the spectrum of the MNO is used and, in some cases, shared.

This scenario imposes some special considerations on the overall network architecture that need to be taken into account and are further explored in the Transport and IP Architecture Module.

Spectrum Leasing

NaaS operators can lease the spectrum from a third party (e.g. MNO, WISP) in order to provide LTE services. This represents an additional recurrent cost to NaaS operators that may impact the overall deployment business case.

In addition, an accurate capacity forecast analysis must be performed in order to determine the amount of bandwidth to lease. If this is not well-forecasted, the NaaS operator may over or underutilize the leased bandwidth.

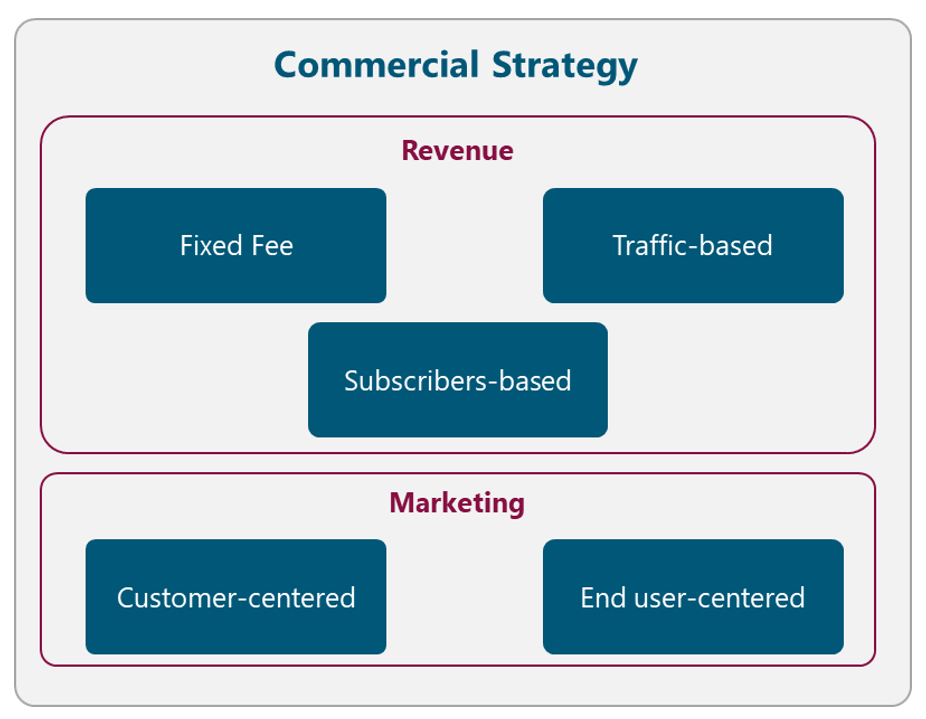

5.1.4 Commercial Strategy

The commercial strategy of the NaaS operator is composed of two elements: Revenue Strategy and Marketing Strategy. Figure 9 displays the different alternatives related to the Commercial Strategy. The NaaS operator must evaluate each alternative and select the most appropriate according to its conditions. The final decision must be recorded in the Strategy & Scope Definition Template.

Figure 9. Commercial Strategy Alternatives

5.1.4.1 Revenue

The Revenue Strategy must identify Revenue Streams within the NaaS operator environment. The nature of each of the streams is different, so a specific Pricing Strategies are required for each of them.

The applicable pricing strategies in the context of the NaaS operator are:

In this way, the different Revenue Streams can be classified accordingly. Table 3 displays a typical Revenue Streams classification for a NaaS Operator.

|

Revenue Stream |

Description |

Customer |

Pricing Strategy |

|

LTE Service Provisioning |

Revenue is generated by the provision of the LTE service to 3rd party entities. |

MVNO, specially Light-MVNOs |

– Fixed Fee – Traffic-based – Subscribers-based |

|

RAN Infrastructure Leasing |

Revenue generated by leasing its RAN infrastructure |

MNOs or WISPs |

– Fixed Fee |

|

Roaming Agreements |

Revenue generated for providing LTE service to MNO’s subscribers in an area where only the NaaS operator have coverage |

MNOs |

– Traffic-based |

Table 3. Typical Revenue Classification for a NaaS Operator.

5.1.4.2 Marketing

The Marketing Strategy describes the specific types of Marketing Models that NaaS operators will implement in order to promote its services among its direct customers and end-users.

The marketing models that the NaaS operator should consider are presented in the following subsections.

Customer-centered

This model is part of the Engagement Operator package and is focused on promoting the differentiators of the NaaS operator services among its direct customers (e.g. MNOs, MVNOs). The aim is to demonstrate and explain the advantages of using NaaS operator services (e.g offer cheaper broadband mobile service focused on rural connectivity).

Once an engagement is established, periodic approaches can be performed in order to consolidate and strengthen NaaS operator position.

The usual channels of communication used by this model are Email and Face-to-face Meetings.

End-user-centered

The focus of this model is to announce and promote the NaaS operators services among end users (i.e. mobile subscribers). These end users may not buy directly from the NaaS operator, however, they need to be aware that they are making use of its services. This type of marketing is very important when a NaaS operator brings connectivity to a new area, so the inhabitants aware that this new connectivity exists.

This model expects to encourage further positive purchase-related behavior. This can be in the form of subscribers visiting the NaaS operator website, read about it, and share.

The typical channel communication used by this model is mass media (e.g. Social media, TV spots, radio advertisement, printed newsletter)

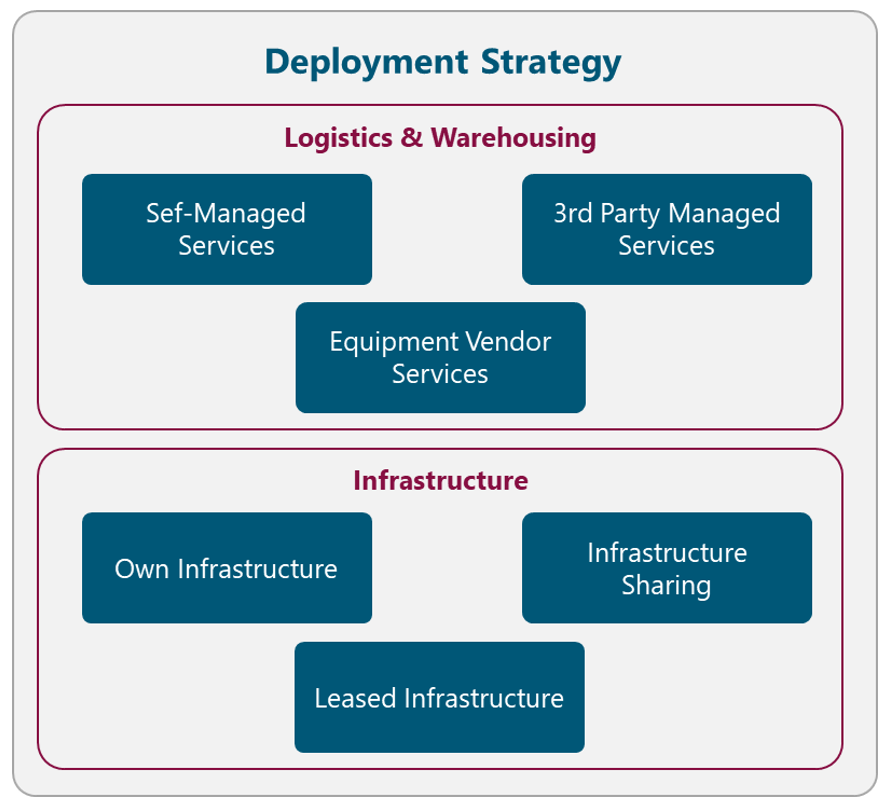

5.1.5 Deployment Strategy

The commercial strategy of the NaaS operator comprises two aspects: the Logistics & Warehousing and the Infrastructure strategy. Figure 10 displays the different alternatives related to the Logistics & Warehousing Strategy. The NaaS operator must evaluate each alternative and select the most appropriate according to its conditions. The final decision must be recorded in the Strategy & Scope Definition Template.

Figure 10. Deployment Strategy Alternatives

5.1.5.1 Logistics & Warehousing

Logistic & Warehousing describes the form in which all the network equipment and ancillaries are stored and distributed. The possible alternatives to implement these services are described in the following subsections.

Self-Managed Services

One alternative to perform the Logistics and Warehousing services is that the NaaS operator implements them with its own resources and facilities. This option is only applicable if the NaaS operator already has an existing implementation of these services or if it possesses enough resources to implement them. Another case that fits this strategy is for small NaaS Operators with no more than a handful of sites as little space to store equipment is required.

The implementation of this option requires an additional design phase if the Logistics & Warehousing services are not already deployed. Furthermore, it may represent additional costs such as Warehouse rent of space and specialized Management Systems.

More details on the processes related to Logistics & Warehousing design and implementation are included as part of the Logistics & Warehousing Module.

3rd Party Managed Services

Another option for the NaaS operator consists of hiring a 3rd party Logistics and Warehousing Company to manage these services. In this way, the operations of these services are the responsibility of the 3rd party, lightening the operational workload of the NaaS operator.

This option is recommended for the NaaS operator as the burden of these services will decrease when the deployment phase is completed and only will apply for the spare equipment.

Equipment Vendor Services

Some vendors offer Transportation & Logistics services for their equipment, so NaaS operators can rely on them. However, this only applies to certain regions and vendors that include these services as part of its purchase agreements. If the vendor provides these services as an additional feature, the considerations of the 3rd Party Managed Services are applicable.

5.1.5.2 Infrastructure

The Infrastructure strategy describes the model that NaaS operators will implement to build and manage the required network infrastructure (e.g. Fiber Infrastructure, Sites, and Towers). The following subsections examine different models to implement this strategy.

Own Infrastructure

The NaaS operator can perform these activities with its own resources if it already has an existing infrastructure (e.g. MNO with existing mobile network, Tower/Fiber Companies) or if it possesses enough resources (e.g funding and personnel) to deploy them.

The development of this option requires an additional design phase for the new infrastructure to be deployed and additional time to acquire the sites. Moreover, it may represent high additional costs such as material (e.g. fiber optic, steel), machinery and equipment construction.

More details on the processes related to the infrastructure design and implementation are included as part of the Tower/Site construction and Fiber Construction modules.

Infrastructure Sharing

Infrastructure sharing models can have a profound, positive impact on the economics of network deployment into rural and remote areas. In this model, the involved partners share the capital and investment costs of the network infrastructure deployment. For NaaS operators, potential partners to be considered by the NaaS operator are MNOs with no coverage in the area, Tower or Fiber companies.

When the infrastructure is already deployed, the operation and maintenance tasks can be shared or can be absorbed by one of the parties as part of the initial agreements.

Leased Infrastructure

If there is infrastructure available in the area, the NaaS operator can lease the infrastructure to a 3rd party (e.g. MNO with 2G/3G coverage, Tower/Fiber Companies). In this form, the NaaS operator can avoid investment in new infrastructure deployment. The most common type of leased infra is in the form of telecom towers and transport networks.

Additionally, the operation and maintenance of the infrastructure are absorbed by the 3rd party, lightening the operational workload of the NaaS operator.

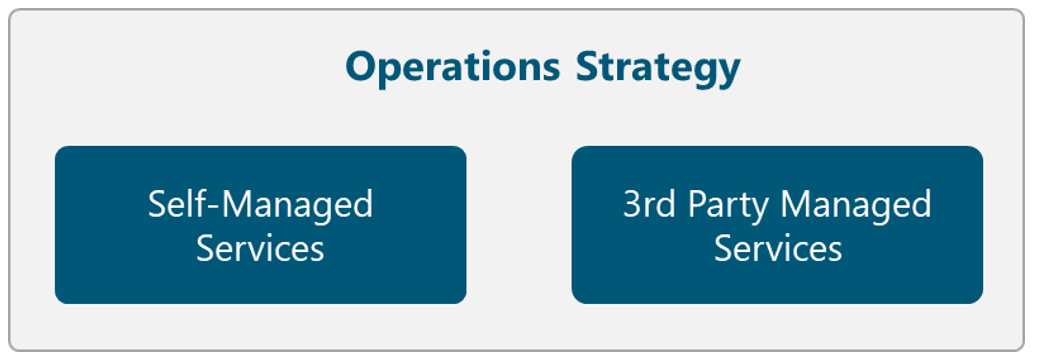

5.1.6 Operations Strategy

The operations strategy defines the model that NaaS operators will follow to perform the network operation and maintenance tasks. This includes the management of the Network Operation Center (NOC), Field Maintenance and Service Operations Center (SOC), as required. Figure 11 displays the different alternatives related to the Operations Strategy. The NaaS operator must evaluate each alternative and select the most appropriate according to its conditions. The final decision must be recorded in the Strategy & Scope Definition Template.

Figure 11. Operations Strategy Alternatives

Self-Managed Services

The NaaS operator can perform the network operation and maintenance activities with its own resources and facilities.

However, it represents additional costs for the required specialized staff to perform the activities. Furthermore, it may represent additional costs such as rent of space and specialized Network Systems.

3rd Party Managed Services

An alternative option is to hire a 3rd party Company that manages the network operation and maintenance activities. In this way, these activities are the responsibility of the 3rd party, lightening the operational workload of the NaaS operator.

This model is also convenient when sites are deployed in rural locations that are far away the locations the NaaS operates from. Therefore, the disposal of local resources is also a deciding factor to select a 3rd party company.

In this scenario, the cost of specialized hardware cannot be avoided because most of the network equipment requires a Licensed Software to perform the network operation and maintenance activities.

5.1.7 Organization Design

The organization design specifies the division of functional areas within the NaaS operator structure. It establishes the different levels of hierarchy within the organization and delimits the responsibilities of each of them.

Figure 12 presents a typical NaaS operator organizational structure. This structure includes a Leadership Team which develops the Strategy & Scope and the High-level Project Plan.

Figure 12. Typical NaaS operator Organizational Structure.

displays five areas that are required for the successful operations of the NaaS operator:

Depending on the size of the NaaS operator, the management and supervision of the available resources can be done by one person for all the areas. However, in larger organizations, a manager for each function might be required. The specific resource requirements for each of the presented areas are examined in more detail in the High Level Project Plan Module.

5.2 Long-Term Strategic Objectives Definition

A long-term strategic objective is a long-term (e.g. 3-5 years), broad, continuous statements that holistically address the different areas of the NaaS operator. Long-term objectives that are viable and appropriate should remain as something that will not change and must be achieved.

The long-term strategic objectives should consider the SWOT analysis. In this way, they will be built on the strengths of the company, fix weaknesses, pursue opportunities and resolve any threats.

In order to define the long-term strategic objectives, the key activities that need to be performed to achieve the vision must be identified considering the strategies presented in section 5.1.

An example of a long-term strategic objective in the NaaS operator context is:

5.3 Set Organization-Wide Goals and Measures

Once the long-term objectives have been identified, they must be translated into goals and measures that can be clearly communicated to the leadership team. Effective goals clearly state what, when, how, and who, and they are specifically measurable. They should address the tasks that need to be performed in the short-term (1-3 years) to achieve the strategic objectives.

The organization-wide goals should present the following characteristics:

Examples of long-term strategic objectives in the NaaS operator context that comply with the SMART characteristics are:

6 Organizational Governance & Performance

This section includes methodologies to control and manage the implementation of the defined strategies. The governance definitions aim to communicate the overall strategies as well as measure and monitor progress towards strategic targets.

6.1 KPI Definition

Key Performance Indicators (KPIs) are the critical indicators of progress towards an intended result. KPIs provide a focus for strategic improvement and create an analytical basis for decision making.

In order to generate a KPI for the strategy implementation, the following elements must be defined:

A useful form to present the KPIs is through the use of the Strategy Scorecard as displayed in Table 4. The NaaS operator should construct a similar Strategy Scorecard with the specific objectives KPIs for each of the Strategies presented in Section 5.1.

|

Strategy Name |

||||

|

Goal |

Units of Measure |

Target |

Frequency |

Source |

|

Goal 1 |

|

|

|

|

|

Goal 2 |

|

|

|

|

Table 4. Strategy Scorecard Format

The aim of the Strategy Scorecard is to identify adjustments over the time according to the KPIs behavior.

An example of the definition of a KPI in the NaaS operator context is presented in Table 5. KPI Example.

|

Deployment Strategy |

||||

|

Goal |

Units of Measure |

Target |

Frequency |

Source |

|

Operational Sites |

Number of sites |

9 sites |

Monthly |

Project Plan |

|

Subscribers |

Number of subscribers |

3300 subscribers |

Annually |

Project Plan |

|

Data Volume |

Aggregated Mbps |

600 Mbps |

Monthly |

Project Plan |

Table 5. KPIs Example

6.2 Establish Schedule for Progress Reviews

Holding regular strategy reviews is the key to the implementation of the Strategies. These meetings will give the ability to manage activities that drive future results and hold people accountable for making sure those activities happen. Furthermore, the adopted strategies can change based on competitors and government actions, therefore, strategy meetings are important as the world around the NaaS evolves.

A Schedule for Progress Reviews must be defined, describing the specific dates and communication channels to communicate with stakeholders regarding the strategic plan and the associated progress. This schedule should be employed by strategy managers in the organization to ensure the awareness about the intent and progress of the strategic plan is fully understood by key stakeholders.

The following steps must be perform to define the Schedule for Progress Reviews:

6.3 Goal Tracking Methodologies

The NaaS operator must establish the performance management review system in order to track the progress towards the goals to identify possible issues and make course corrections if necessary.

One alternative is to use the Strategy Scorecard method presented in Section 6.1 as a performance management review system. In this way, the Strategy Scorecard must be presented by the responsible people during each meeting.

Additional tools such as management and technology systems can help track the progress of the plan and make it faster to adapt to changes. As part of the system, milestones can be built into the plan that must be achieved within a specific time frame.

6.4 Review and Adapt Process

A Strategic Planning Retreat must be held at least once per year. During this session, all the elements in the Strategy, including the Mission and Vision Statements must be reviewed in order to confirm that are current and still relevant to the NaaS operator.

The following elements must be considered to perform the Strategic Planning Retreat:

After updating the Strategy Plan, it must be distributed to all elements within the organization to align the priorities and ensure that everyone knows what they are responsible for.

1. Introduction: High Level Overview

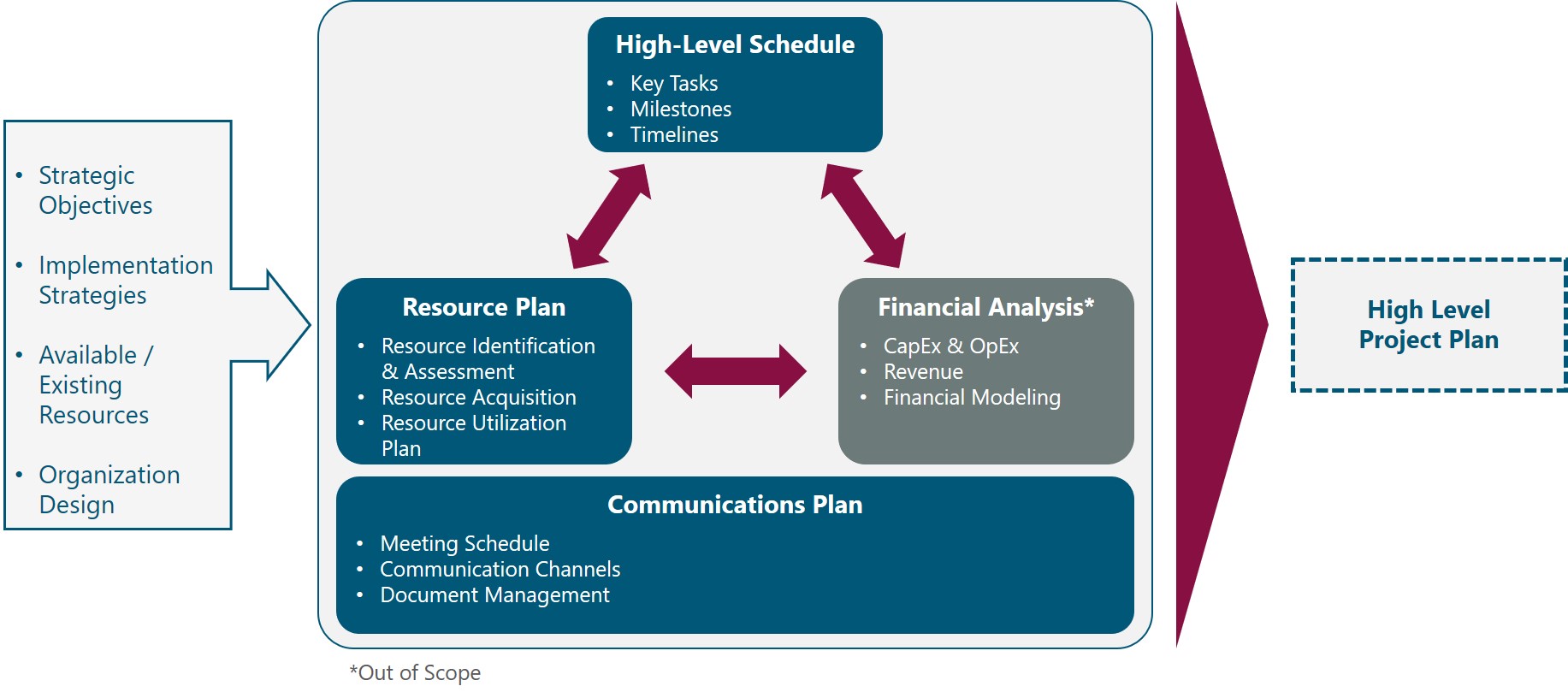

Development of the High-Level Project Plan is the immediate next step after Strategy & Scope definition of the NaaS Initiative. Together with the NaaS Strategy, the High-Level Project Plan serves as a roadmap to stand-up the NaaS Operator. It provides the reference plan to manage and control critical tasks. It also provides task and timeline guidance for detailed planning associated with Design, Deployment and Operation of the Network.

This module describes the key planning areas and components. It aims to transform the Strategic Plan into an actionable plan in the key areas of Schedule, Resources and Communication Plans.

Together, these elements comprise the High-Level Project Plan, which is the catalyst for action and provides the NaaS Operator and key stakeholders a holistic view of what needs to be done, the resources required, and a guidance on how to communicate the plan across the NaaS Organization.

1.1 Module Objectives

This module will enable NaaS Operators to establish a High-Level Project Plan to organize and coordinate all the activities required to build and turn-up a NaaS Initiative. The specific objectives of this module are to

- Provide an information base of fundamental planning aspects for a NaaS Initiative, creating awareness of the interactions among these aspects and NaaS Strategy.

- Guide the NaaS Operator to identify all the required resources and generate an efficient plan for resource acquisition and utilization.

- Provide guidelines to identify key tasks and milestones, and generate a High-Level Schedule that aims to achieve NaaS Operators strategic goals and objectives.

- Support NaaS Operators to define a Communications Plan that provides an Organization-wide structure for meetings, reporting, communication channels and documentation.

1.2 Module Framework

The Module Framework in Figure 1 describes the structure, interactions and dependencies among different NaaS operator areas.

Strategic Plan & Scope is the first stream to build the NaaS Operator. The modules in this stream aim to drive strategic decisions that impact all the downstream modules. From this point, High-Level Network Architecture can be defined, establishing the guidelines for Network Design which in turn kick-starts the deployment phase.

High-Level Project Plan comes after Strategy & Scope definition. However, there is an interaction between the outputs of these modules, in the sense that High-Level Project Plan may trigger updates to Strategy & Scope.

Figure 1. Module Framework

Figure 2 presents the High-Level Project Plan functional view, where the main functional components are exhibited. Each component is discussed in its own section of the outline, detailing the impact on other blocks and a process to generate an integrated High-Level Project Plan.

Figure 2. High-Level Project Plan Functional View

The rest of this module is structured as follows: Section 2 presents an overview of the NaaS Planning components and its interaction with the Strategy. Sections 3 to 5 provide deeper analysis and guidance to perform actual Resource, Schedule, and Communications Plan in the context of rural NaaS initiatives.

2 High-Level Project Plan Overview

This section presents the key aspects and components to elaborate a High-Level Project Plan, emphasizing their relevance for the NaaS Operator and interdependency with the NaaS Operator Strategy & Scope.

2.1 Strategy & High-Level Project Plan Interaction

Strategy and scope of the NaaS Operator are first established to set the route that the NaaS Initiative will take and the general methods to be used to reach the long-term objectives.

However, the only way the Strategy gets executed is to align resources and actions through an effective Project Plan that translates the Organization Strategies and Objectives into structured tasks and timelines that fit available resources.

Outputs from Strategic Planning are Organization Strategies and Long-Term Strategic Objectives (See Strategy & Scope Module). These outputs are the starting point and provide a general guide for the High-Level Project Plan, which aims to answer how the Strategy and Objectives will be achieved and who must do what to accomplish them.

Based on the above, it is fair to say that the Strategy drives the Project Plan. However, in todays rapidly changing environment, NaaS Operators may find during the development of the Project Plan that certain assumptions are not valid or that additional constraints that werent considered during Strategy definition must be incorporated. Thus, an iterative planning approach must be applied in which findings from the High-Level Project Plan triggers updates to the Strategy restarting the planning cycle until the NaaS Operator approves both Strategy and Project Plan.

This module enables NaaS Operators to establish a High-Level Project Plan to organize and coordinate all the activities required to build and turn-up a NaaS Initiative based on the NaaS Operator strategy.

2.2 NaaS Planning Fundamentals

In the following sections, an initial description of planning components is provided to build a holistic view of the planning process.

2.2.1 Resource Plan Overview

NaaS Operators require different types of resources to plan, deploy and operate the network and the services it provides. These resources can be categorized as follows:

In addition to the resources above, services are considered as part of the Resource Plan. However, it is important to note that services are not the same as resources. Services are provided by 3rd Parties and are used to satisfy a requirement over a period of time, i.e. they are temporary. In some cases, instead of acquiring a specific resource NaaS Operators may decide to contract a service that replaces the required resource.

The Resource Plan specifies how the above resources should be categorized, acquired, managed, and released. The Resource Plan for NaaS Operators must include at minimum the following items:

- Resource Identification. Identification and quantification of the required resources to accomplish objectives.

- Resource Acquisition. Plan and guidelines on how the resources will be acquired. A separate section should be considered for staffing in which specific positions and responsibilities should be taken into account.

- Resource Management. Details on how and when resources will be utilized, considering guidelines for allocation, control, and release of resources.

Further details and guidance for the development of the Resource Plan are provided in Section 3.

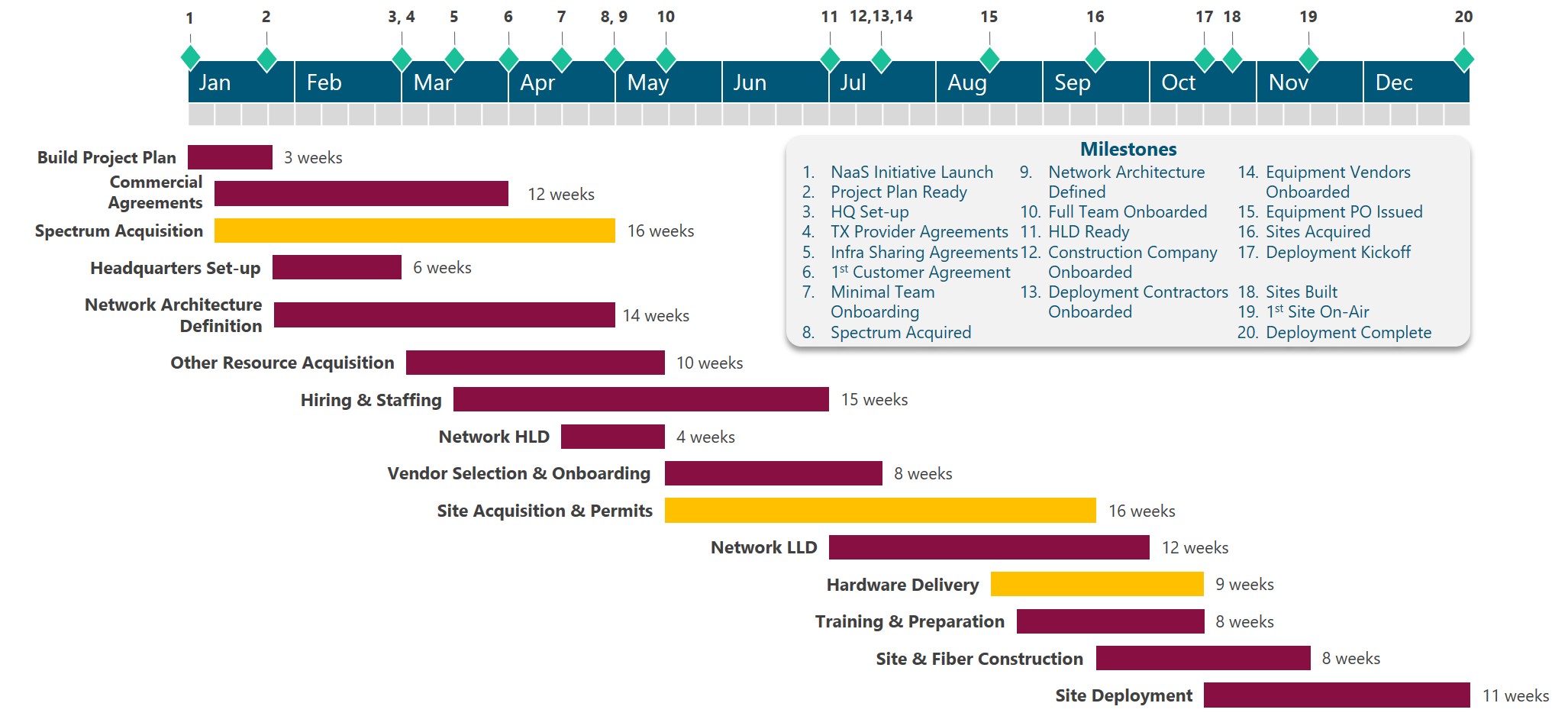

2.2.2 Schedule Overview

Project scheduling provides a plan that describes when the Project Milestones will be delivered and the activities involved to achieve these milestones, including duration and dependencies among activities. As part of the High-Level Project Plan, the Schedule serves as a tool for communication, managing stakeholders expectations, and as a basis for reporting.

As can be expected, there is a myriad of tasks that must be planned and managed throughout the Lifecycle of the NaaS Initiative. This Module contemplates activities from NaaS Initiative launch up to the completion of Deployment and entrance into Operations Phase. At a high level, the milestones and tasks can be grouped into three categories:

Specifying the Project Schedule is of paramount importance to manage the timely completion of the Project and the achievement of the NaaS Initiatives goals and objectives. Through the analysis of activities sequences, durations, resource requirements, and schedule constraints the project schedule creates a baseline for project execution, monitoring and controlling.

Conditions of every NaaS Operator are different; thus, specific tasks will vary across the NaaS spectrum based on Operators Strategy, existing resources, size of the network, financial constraints, and technology requirements. In a similar vein, task sequencing, interdependencies and duration may vary as well.

A comprehensive assessment of these variations and a method to develop a Project Schedule is presented in Section 4 through the analysis of a generic schedule. In addition, instruction for customization of the generic schedule is provided, including task duration estimation, task sequencing and schedule validation.

2.2.3 Financial Analysis Overview

A critical component of the High-Level Project Plan is a Financial Analysis or Business Model that models the financial performance of the Initiative. It is the primary tool to get investors to buy-in the Project and obtain private or public funding. Ultimately the Financial Analysis will be the baseline for comparison and the decision instrument to approve the Project Plan.

Based on NaaS Strategy and Objectives, and other components of the Project Plan, the financial analysis presents forecasts for costs, revenues, profits and cash flows, and obtains financial metrics such as return-on-investment (ROI), Break-even Year, net present value (NPV) and internal rate of return (IRR).

This analysis is usually done during the early phases of the NaaS Initiative, sometimes before the Strategy definition, and refined during the Project Plan. Furthermore, each Organization may have a different method, scope, requirements and set of metrics for the Financial Analysis. In consequence, a detailed treatment of the Financial Analysis is out of the scope of the PlayBook and it is left to the NaaS Operator to use the methodology and metrics that best fit their needs and requirements.

In any case, it is important to consider at least the following inputs for the Financial Analysis:

2.2.4 Communications Plan Overview

The Communications Plan is the component of the High-Level Project Plan that documents how communications across the NaaS Organization are structured, implemented and monitored. It defines the mechanisms for communications activities based on information needs, the methods to distribute information and coordinate tasks, and the methods for storage and retrieval of information.

The implementation of an effective Communications Plan provides the following benefits:

For NaaS Operators, these benefits can be translated into one key success factor: it avoids delays and re-work due to miscommunication and lack of coordination. This is of utmost importance to keep the initiative alive and financially healthy due to the high cost of re-work and financial constraints that are faced by rural NaaS Operators.

The Communications Plan for NaaS Operators must include at minimum the following items:

In addition, communication to external entities should be considered, establishing rules and policies to share marketing, technical and other confidential information. External communication should consider any constraints derived from specific legislation or regulation and it is considered out of the scope of this module.

Section 5 presents a detailed view of the Communications Plan providing guidance for the NaaS Operator to build their own Communications Plan.

3 Resource Plan

This section explores the tasks and factors involved in Resource Planning, including guidelines for the NaaS Operator to develop their own Resource Plan.

3.1 Resource Identification & Assessment

The first step towards a Resource Plan is to identify the required resources according to the Scope and Strategy of the NaaS Initiative. This is usually done through brainstorming and resource breakdown techniques using objectives and categories of resources to go from general categories to specific individual resources.

Then, after identifying individual items, each item should be quantified based on the scope and strategic objectives.

To simplify this process, a generic list with the most common resources categories and subcategories, and guidance to identify applicability for the initiative is provided in Table 1. NaaS Operators are encouraged to use this table to identify their required resources.

|

Category |

Subcategory |

Description |

Applicability Criteria |

|

Spectrum |

RAN |

Spectrum used by the LTE System. It could be licensed or unlicensed. |

Always required |

|

Microwave |

Spectrum used by microwave links. It could be licensed or unlicensed |

For NaaS Operators using Microwave backhaul |

|

|

Telecom Infrastructure |

RAN Sites |

Physical Site and civil infrastructure for RAN equipment deployment. Examples are Towers, Poles, Rooftops. Land plots may be considered as well for Greenfield sites This category includes cabling and supporting infra to route cables and host equipment such as cabinets, racks, ODFs and trays. |

Always required. (Type of site and specific requirements vary by NaaS Operator) |

|

Transport Nodes |

Aggregation Sites with existing transport/fiber connectivity that may as well be considered for RAN Installation |

Required except for the case of a network using satellite backhaul only with a 3rd Party or Cloud Mobile Core |

|

|

Datacenters |

IT or Telco Facility that hosts Compute, Networking and Storage Infrastructure that supports Systems and virtualized elements such as virtual EPC |

Required for private cloud implementation to support a virtualized core and other Systems. Does not apply for public cloud services or basic server deployment at an IT room in the Headquarters or other network sites |

|

|

Fiber Infra |

Civil and Optical outside plant infrastructure used to provide transport connectivity. Includes Ducts, Poles, Fiber Cables, Splicing Boxes, etc. |

Required if fiber backhaul is being deployed and/or managed by the NaaS Operator. If using a 3rd Party fiber backhaul service, the NaaS Operator is not responsible for this resource |

|

|

Power Infra |

Power cabling, electrical boards, switches, regulators and grounding |

Always required. Might be included as part of the tower/site leasing service |

|

|

Network Equipment |

RAN |

LTE Base Stations |

Always required |

|

Transport |

Last Mile and Aggregation Transport Equipment consisting of microwave radios, routers, switches, and satellite modems (VSAT) |

Always required. Equipment varies depending on the transport technology |

|

|

Power Equipment & Batteries |

Components of the systems to power equipment at network sites, including solar panels, controllers, rectifiers, power over Ethernet (PoE) injectors, Batteries, etc. |

Always required |

|

|

Antennas |

Various type of antennas required to transmit and receive radio signals. Includes RAN, microwave and GPS antennas |

Always required (at least RAN Antennas) |

|

|

Mobile Core |

EPC and Policy and Charging Control nodes, that are usually implemented as virtualized appliances |

Depends on Strategy and Mobile Core Architecture. Only applies when implementing a mobile core instead of using a 3rd Party or cloud core |

|

|

IT infrastructure |

Servers and networking components that support systems, which might include virtualized network functions |

Required if implementing virtualized elements (e.g. core) or systems in a private cloud environment |

|

|

Installation & Construction Materials |

Cables & Connectors |

Cables, connectors and associated materials (e.g. tape) that are used for equipment installation and connection: Electrical, Coaxial (RF) and Optical Cables |

Always required. Might be provided as part of a 3rd Party Installation & Commissioning service |

|

Mounting Hardware |

Miscellaneous elements required to install and mount network equipment |

Always required |

|

|

Construction Materials |

Structural and building materials required for site and fiber construction, including bricks, concrete, blocks, steel, ducts, pipes, etc. |

Required for site and fiber construction. Usually provided as part of the service with a Construction Company |

|

|

Tools |

I&C Tools |

Tools used throughout the installation and commissioning process, up to acceptance testing such as Smart Phones (UEs) & Test Applications, Power & Hand Tools, RF & Network Testing Tools, Safety Equipment, Communications Equipment |

Always required. Usually provided as part of a 3rd Party Installation & Commissioning service |

|

Construction Tools & Machines |

Heavy Equipment and other construction tools required for site and fiber construction |

Required for site and fiber construction. Usually provided as part of the service with a Construction Company |

|

|

Vehicles |

Cars and trucks for equipment transportation, site surveys, maintenance and any other field task |

Required if the NaaS Operator is expecting to perform site activities through its own personnel |

|

|

Systems |

Network Operations |

Management, Monitoring, Inventory, Ticketing, Billing |

Always Required |

|

Engineering Tools |

RF and Microwave Planning Tools for High and Low Level Network Designs |

Depends on network size and overall strategy. |

|

|

Business/ Enterprise Systems |

Billing and Administrative Software, Document Management, Project Management, etc. |

Systems to be implemented vary by NaaS Operator |

|

|

Facilities |

Buildings |

Facilities apart from network nodes such as Headquarters, Warehousing, and network operation center (NOC) |

Headquarters are always required. Other facilities can be avoided by using 3rd Party Services or converged at Headquarters |

|

Office Equipment & Furniture |

Required items at the office: Desks, chairs, PCs, Printers, Phone, etc. |

Always required. Specific items will depend on NaaS Organization size, structure, and scope |

|

|

Staffing |

Executive Team |

Directors and/or managers responsible for the overall management (Managing Director) and specific departments such as Technical, Operations and Commercial |

Always required. Size and specific functions may vary |

|

Engineering Team |

Personnel in charge of network planning and engineering |

Always required. Size and scope may vary |

|

|

Deployment Team |

Personnel in charge of coordinating and executing site deployment, installation, commissioning and integration |

Always required. Size and scope may vary |

|

|

Operations Team |

Personnel in charge of network monitoring, maintenance, fault management and ensuring service availability and performance |

Size and scope may vary and sometimes can be merged with Deployment Team. |

|

|

Commercial / Sales |

Personnel in charge of engaging with customer MNOs and other business relationships |

Not always required, depending on size and Organization Strategy: Functions may be converged with Financial/Legal |

|

|

Financial / Legal |

Personnel in charge of procurement and legal aspects in the Organization |

Not always required, depending on size and Organization Strategy: Functions may be converged with Commercial/Sales. Legal functions might be outsourced |

|

|

Others (HR, Compliance, etc.) |

Personnel in charge of other supporting and ancillary functions such as human resources, performance, compliance |

Depends on Organization Strategy |

|

|

Services |

Transport & Internet Connectivity |

Enterprise and network connectivity services acquired from a 3rd Party. This includes Terrestrial and Satellite backhaul as well as Internet Connectivity |

Always required |

|

Deployment |

Equipment transportation, Installation and commissioning services for site deployment |

Depends on Organization Strategy |

|

|

Construction |

Civil works to build or adapt a network site or to deploy fiber outside plant infrastructure |

Depends on Organization Expertise and Scope |

|

|

Grid Power |

Power service from an electrical company |

Always required |

|

|

NOC |

Managed service for network Operation that may include different tiers and functions such as monitoring, ticketing, service desk, fault management and incident management |

Depends on Organization Strategy and size of the network |

|

|

Warehousing & Logistics |

Hardware transportation and warehousing service |

Depends on warehousing requirements, geographical span of the network and NaaS Organization Strategy |

Table 1. Generic List of NaaS Resources.

In addition, to detail staffing resources, Table 2 provides generic positions and key activities that can be easily adapted to the specific NaaS Organization.

|

Position |

Reports To |

Key Activities |

|

Managing Director |

Board / Investors |

.Overall Management |

|

Technical Director |

Managing Director |

.Lead network and systems decisions |

|

Financial/ Commercial Director |

Managing Director |

.Manage legal, commercial and financial activities |

|

|

|

|

|

Engineering |

|

|

|

Engineering Manager |

Technical Director |

.Oversee and engage in network planning, design and optimization activities |

|

RAN Engineer |

Engineering Manager |

.RAN site planning, design and optimization |

|

Transport Engineer |

Engineering Manager |

.Transport network planning, design and optimization |

|

Core Engineer |

Engineering Manager |

.Mobile core planning, design and optimization |

|

|

|

|

|

Deployment |

|

|

|

Deployment Manager |

Technical Director |

.Planning, control and monitoring of network deployment activities |

|

Deployment Engineer |

Deployment Manager |

.Inventory, warehousing and kitting |

|

Integration Engineer |

Deployment Manager |

.Support field activities |

|

Deployment Technician |

Deployment Engineer |

.On-site Installation & Commissioning |

|

|

|

|

|

Operations & Maintenance |

|

|

|

O&M Manager |

Technical Director |

.Lead network operations, preventive and corrective maintenance |

|

Systems/IT Engineer |

O&M Manager |

.Implement, operate and maintain network and IT Systems |

|

NOC Operator |

O&M Manager |

.Monitor network status and performance |

|

Site Technician |

NOC Operator |

.Preventive and corrective field maintenance |

|

|

|

|

|

Commercial / Business Development |

|

|

|

Sales Manager |

Financial/ Commercial Director |

.Manage engagement with customers |

|

Sales Executive/ Representative |

Sales Manager |

.Point of contact for customers |

|

Procurement Manager/Analyst |

Financial/ Commercial Director |

.Supply chain management |

|

|

|

|

|

Financial & Legal |

|

|

|

Financial Specialist |

Financial/ Commercial Director |

.Accounting and payments |

|

Legal Associate |

Financial/ Commercial Director |

.Manage agreements, permits and other legal issues |

|

|

|

|