Network as a Service (NaaS) PlayBook

1. RAN Optimization Introduction

Radio access network (RAN) optimization activities play an important role in post-launched network engineering activities of the NaaS operator, although basic optimization tuning is also required before the network gets on-air. RAN optimization activities are triggered by different use cases including network and service performance degradation as well as customer complaints.

NaaS engineering teams will be responsible for the optimization process, which will include the management of all the inputs required to properly execute the optimization activities. Basic inputs such as network performance, configuration and inventory will be required, whereas other sources that could be used on an ad-hoc basis include drive tests, crowdsourcing, call tracing and others.

Using these data inputs, the NaaS optimization team will execute optimization tasks to monitor and detect unwanted performance situations, analyze and diagnose these situations, prescribe and execute tuning corrections and monitor the impact of the applied network changes, closing this way the on-going optimization cycle.

Module Objectives

RAN optimization module will support NaaS operators’ engineering teams to manage the RAN optimization process. The module has the following specific objectives:

Module Framework

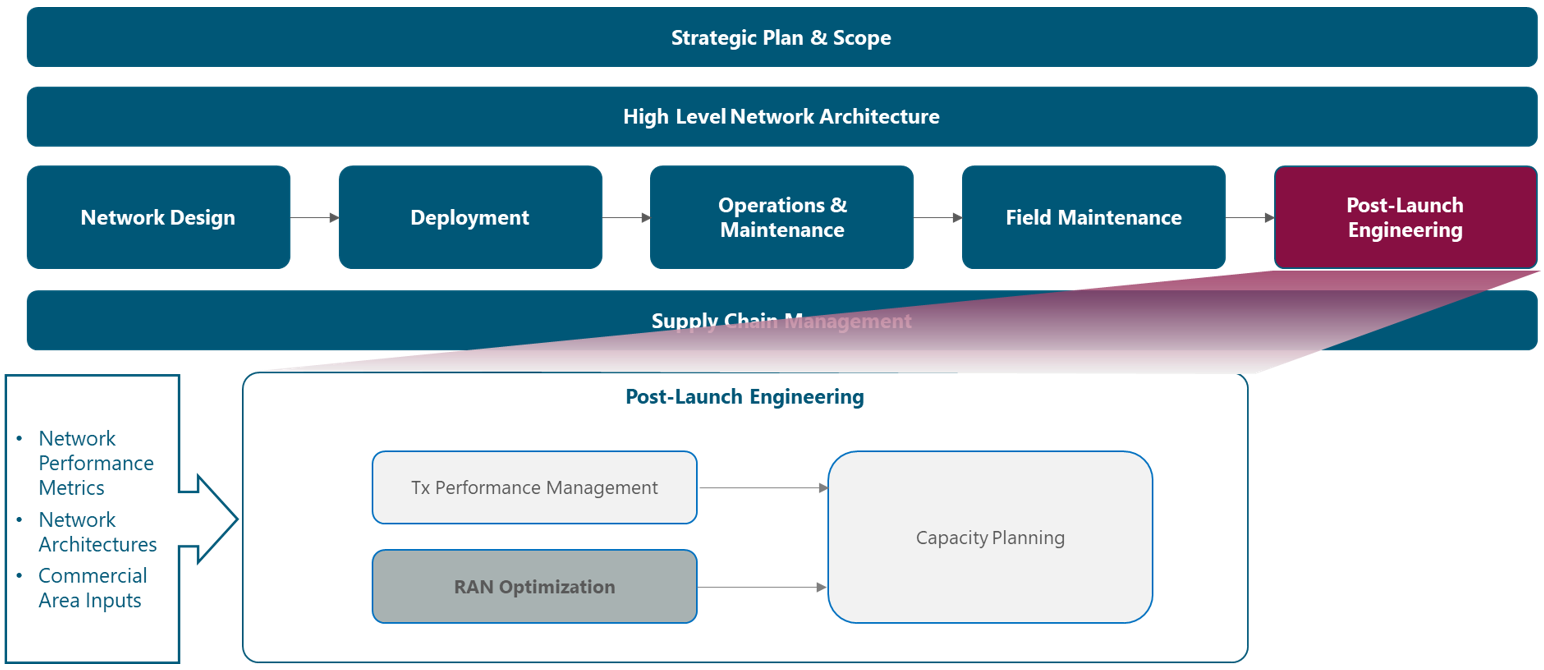

NaaS Playbook’s Framework shown in Figure 1 displays the positioning of the Post-Launch Engineering stream and the modules that comprise it.

The RAN optimization module is part of this Post-Launch Engineering stream, specifically focused on the RAN section of the network. RAN optimization activities will become more relevant when network elements (NE) are already in an operational mode and providing service to the users of the network.

The RAN optimization module is related to other modules in the stream (capacity planning and performance management (PM)). RAN optimization will make use of the Capacity Planning module to understand planned network actions that will impact the analysis phase of the RAN optimization process. RAN optimization can be triggered by different use cases related to the network performance management, being performance degradation and performance improvement plans some of the most relevant use cases to launch optimization actions.

Figure 1. Post-Launch Engineering Playbook stream

The rest of the module is structured as follows:

Section 2 introduces the optimization process framework and provides a high-level description of the areas contained in the framework: Optimization Use Cases, Data sources and Optimization Process. Section 3 describes the main use cases that will trigger the optimization activities. Section 4 focuses on the data sources that are required to perform the optimization activities. NaaS operators’ engineering teams need to be aware of these data sources and ensure the availability of the basic data inputs that will be required to avoid network performance degradation and customer impact. Finally, Section 5 describes the generic flow of tasks in the Optimization Process. This flow of activities will utilize and will monitor the available data sources to detect unwanted situations due to network malfunctioning and apply optimization actions to resolve the issues. The section also presents the most common commercial tools available to process and analyze the data inputs used for RAN optimization.

2 Optimization overall process framework

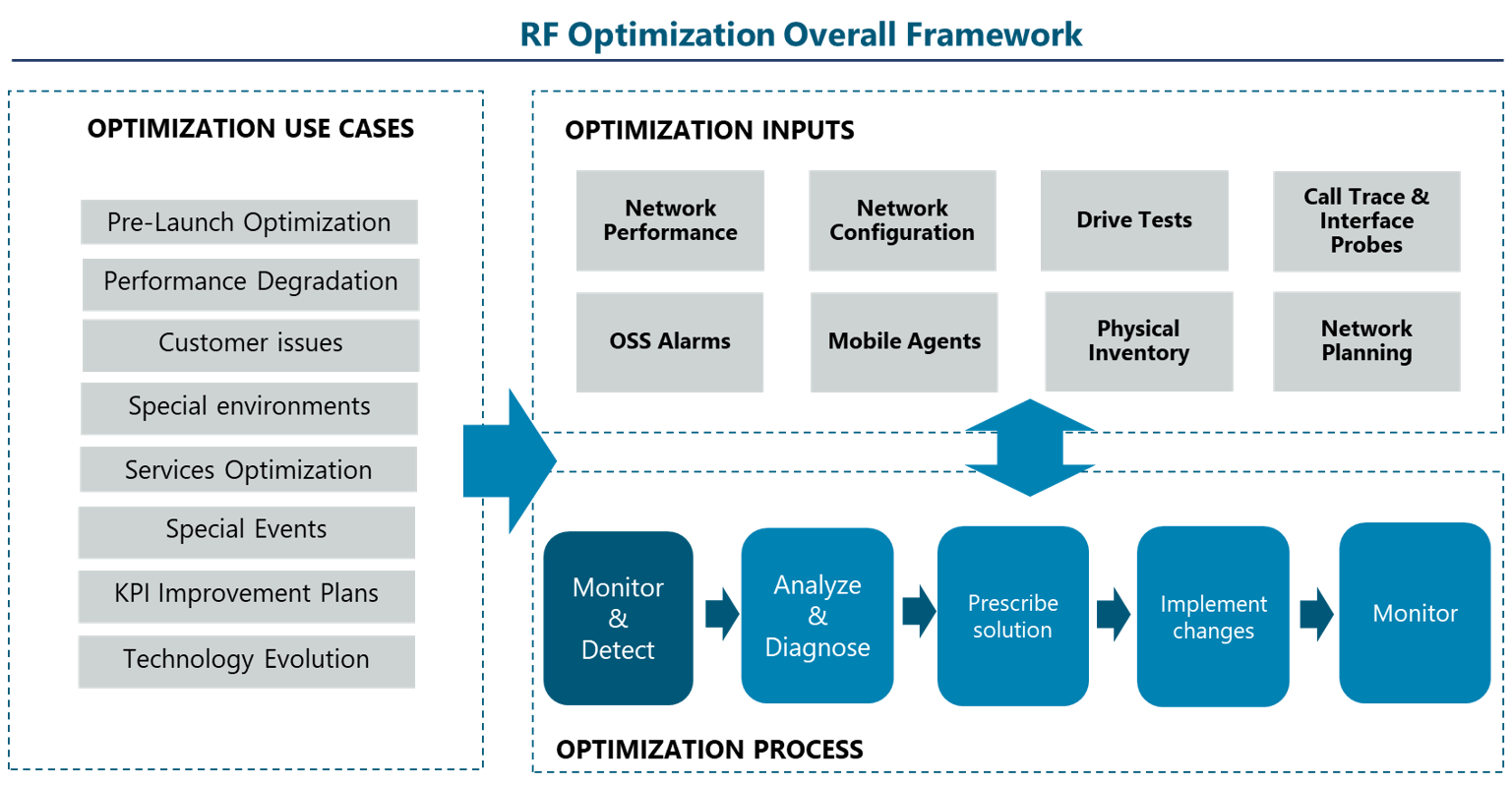

The following figure shows an approach for the overall RAN optimization framework. The framework is split in the areas of Use Cases, Data Inputs and Optimization Process.

As it’s depicted in Figure 2, the RAN optimization process can get triggered by several Use Cases. Attendance to these use cases is required by the NaaS operator to maintain the network in an overall good status to provide services to the users.

To perform the activities in the Optimization Process, it’s required to have access to ‘Optimization Inputs’. These data sources are characterized by different collection methodologies and different formats which require different processing approaches. Tools are available in the market for processing and analysis of these inputs, some of them are specialized in specific inputs (drive-test post-processing tools as an example) while others are already covering an array of different inputs and allow correlation between them to facilitate the analysis.

Figure 2. RAN Optimization framework

The main activities in the ‘Optimization Process’ include the analysis of unwanted situations detected in the available inputs and then the provision and implementation of tuning recommendations (parameter tuning and/or physical attributes tuning). In this area, there are tools in the market that automate the process of generating recommended actions based on integrated knowledge in embedded algorithms. Some of these algorithms are already part of self-organizing network (SON) solutions. SON solutions themselves are available in different formats: multivendor centralized-SON (C-SON) solutions versus distributed-SON (D-SON) solutions or vendor-SON solutions, as well as hybrid solutions.

Different levels of automation in the ‘Optimization Process’ tasks are already being implemented as a necessary step to operate the increased complexity in the networks and overcome the challenges associated with the increased number of technologies and spectrum bands. Automation efforts span from the processing of inputs through the generation of recommended tuning actions and even closing the loop by implementing and monitoring the execution of these tuning actions in the network.

In the case that the network infrastructure deployed by the NaaS operator is serving different customer Mobile Network Operators (MNOs)’ in a multi-tenancy context, the RAN optimization process will follow a similar approach for the different tenants. Depending on the Active sharing scheme (see Figure 3), optimization activities could need to be replicated for the different MNOs (in the multi-operator RAN (MORAN) case):

Figure 3. Active Sharing scenarios

3 Optimization Use Cases

This section introduces a description of Optimization Use Cases, that is, the main reasons driving the execution of optimization activities.

Table 1 lists the considered Use Cases and also introduces attributes related to the periodicity of the optimization activities to address each Use Case, differentiating Use Cases that require ‘on-going’ activities from those that are characterized by ‘occasional’ activities.

Additionally, an attribute is added to characterize each Use Case, attending to the proactive versus reactive approach traditionally used to manage each Use Case, and finally an attribute to consider applicability to rural NaaS operator:

|

Optimization Use Case |

Periodicity |

Reactive / Proactive |

Applicability to Rural Operator |

|

Pre-Launch Optimization |

Occasional |

Reactive |

Medium |

|

NW Performance Assurance |

On-going |

Reactive (some efforts toward proactivity in certain activities) |

High |

|

Customer complaints |

Occasional |

Reactive |

Medium |

|

Special Environments (Highways, Railways, Hotspots,’) |

Occasional |

Proactive |

Medium |

|

Special Events Preparation |

Occasional |

Proactive |

Low |

|

KPI Improvement Plans |

Occasional |

Reactive/Proactive |

Medium |

|

Technology Evolution (new features and technologies) |

Occasional |

Proactive |

Medium |

|

Services Optimization |

On-going |

Reactive/Proactive |

High/Medium |

Table 1. RAN Optimization Use Cases

Pre-Launch Optimization

Pre-Launch optimization is required when the sites are initially deployed, and it’s intended to check that the provided service is aligned with the required performance indicators. The result of the launch optimization is the acceptance of the site(s) to be available for commercial traffic.

Pre-Launch optimization is characterized by noncommercial traffic and by the predominant usage of drive-tests as well as configuration data as the data sources for site/cluster optimization.

The usual approach for the Pre-Launch optimization process is divided in two main activities: Single Site Verification (SSV) and Sites Cluster Acceptance.

Once the site or clusters of sites get accepted, they can become operative for commercial traffic and optimization teams will focus on the implementation of the additional use cases as described in the following sections.

Network Performance Assurance

Network performance assurance implies on-going monitoring of main Network Performance Indicators with the objective to early detect performance degradation and to quickly apply corrective actions to get back to target Key Performance Indicators (KPIs) values. Many Network Monitoring Systems (see Network Monitoring Architecture module) are able to monitor these KPIs in a real time basis (with 15 min delay which is the usual temporal aggregation granularity of performance data in the NEs).

The approach for this Optimization Use Case is usually still reactive in many operators, where optimization groups organized in different tiers (tier-1 being able to perform basic checks in the NEs to tier-2/tier-3 providing more specialized professional services to understand and apply fixes to complex network issues) are focusing their activities in generating a diagnose (i.e., finding the Root Cause Analysis) of the degradation and then prescribing and executing a solution to fix it.

It’s recommended for the NaaS optimization team to utilize SON solutions if they are available to automatically detect performance degradations and apply prescribed tuning actions to affected RAN elements. Further information about SON solutions can be found in section 5.2.

The areas where Performance Indicators should be constantly monitored include the following:

Monitoring of performance degradation must allow the aggregation / disaggregation to different network and geographical levels (network-wide / radio network controller (RNC) / base station controller BSC / Node / Cell / Region / Province) to isolate degradations.

For more information about KPIs which are monitored, please refer to section 4.1.1 (KPI Target tables).

3.3 Customer complaints

Customer issues or complaints are a trigger to launch optimization activities. Sometimes these issues get hidden in overall network performance statistics and cannot be detected via network performance indicators monitoring. Therefore, to troubleshoot these customer specific issues it could be necessary to use additional tools such as Call tracing and data from Core interfaces’ probes to analyze End-to-End (E2E) calls from these users.

KPI Improvement Plans

Another use case triggering optimization activities are tailored plans implemented by NaaS operators to improve specific Performance Indicators (e.g., throughput, latency, capacity utilization).

As an example, competitive benchmarking campaigns may highlight that customer MNO throughput is lower than the one shown by its competitors. Many reasons may lead to this situation: percentage of time in each technology (% in 5G/4G/3G), use of high-order modulation schemes.

Optimization activities associated to KPI improvement Plans are executed occasionally and the approach can be both reactive (i.e., NaaS operator is responding to a ‘known’ problem) or proactive (i.e., NaaS operator is exploring ways to improve results in specific KPIs).

3.5 Special Events Preparation

NaaS operators need to perform optimization activities necessary to guarantee the quality of service in special / massive events that concentrate high density of customers.

These activities are required to prepare the network to hold the traffic peaks expected in these events. During the event, it’ll also be required to perform real time performance monitoring to avoid unexpected service degradations (even if previous planned optimization actions have been implemented).

Activities related to special events preparation usually are occasional, and they follow a proactive approach. During event celebration, real time service assurance will take care of reactive actions if unexpected degradations occur.

Preparation of the event will include the following activities:

3.6 Optimization of Special Environments

Good service experience is required in mobility scenarios such as highways and railways, commuter trains and others. Specific optimization approach is required to optimize these special environments. These activities will include:

The approach for these optimization activities is on-going and reactive. Preferred tools for this type of optimization could for example rely on crowdsourcing data to minimize drive test execution.

3.7 Technology Evolution

This area includes optimization activities oriented toward the introduction of new technologies (4G, 5G, IoT) as well as new features in the network.

General approach is that these optimization activities are occasional, although the NaaS operator may have specific groups fully dedicated to the analysis of new technologies and features. These groups are in charge of the development of configuration guidelines and settings for the deployment across the network of these new technologies/features.

The nature of the activities is proactive since initial tests are performed in specific geographical areas of the network (Golden Clusters) where technologies and features are evaluated isolating or minimizing the impact on operators’ customers.

Activities include the following:

3.8 Services Optimization

This Use Case focuses on Optimization activities performed by NaaS operators which are oriented toward the performance improvement of specific services:

From the above services classification, it’s possible to conclude that NaaS operators’ optimization efforts will be mainly targeted to the technologies (2G, 3G, 4G) carrying each one of these services and which will depend on customer MNO’s networks and strategy. As an example, voice services optimization will mainly focus on 3G (and possibly 2G) if the customer MNO has not launched VoLTE services and/or the penetration of VoLTE market is not significant. On another example, IoT solutions could be based on 2G/Global Systems for Mobile Communications (GSM) networks (GSM-IoT standards) or in 4G/LTE networks (NB-IoT and LTE-M standards).

3. OPTIMIZATION USE CASES

3.1 Pre-Launch Optimization

3.2 Network Performance Assurance

3.3 Customer complaints

3.4 KPI Improvement Plans

3.5 Special Events Preparation

3.6 Optimization of Special Environments

3.7 Technology Evolution

3.8 Services Optimization

Next ⇒

4 Optimization Data Inputs

Optimization actions require the analysis of data inputs with the objective to detect malfunctioning elements and recommend and implement changes in the network to fix detected issues.

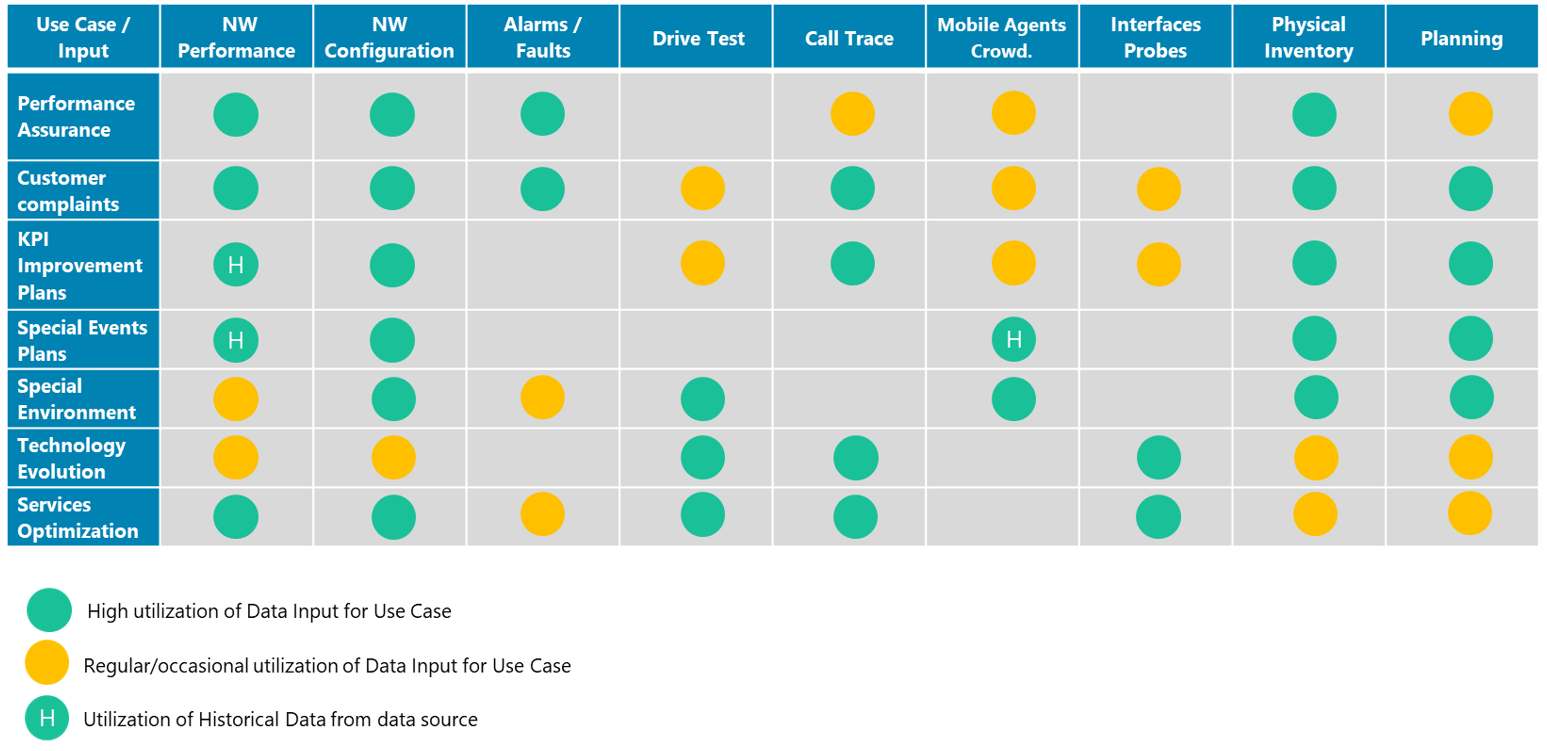

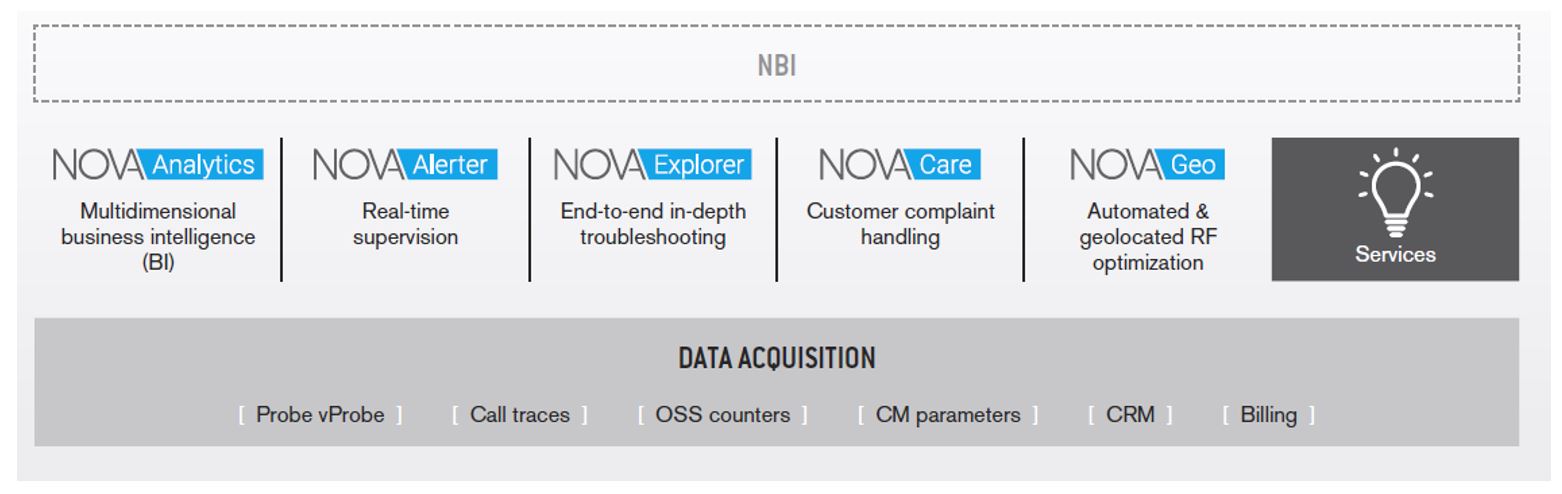

Figure 4 shows an overview of which Optimization data sources are most often used as part of the different Optimization Use Cases:

Figure 4. Data Inputs for Optimization Use Cases

4.1 RAN Performance

RAN performance information is collected from radio access NEs (2G BSCs, 3G RNCs, 4G eNBs, 5G gNBs). RAN performance is a vital input for most optimization Use Cases, although there are few scenarios in which RAN performance is not that meaningful, being the following some examples:

It’s relevant to note that while the usage of real time performance indicators is very much relevant for Use Cases such as Performance Degradation/Service Assurance, there are other Use Cases that also rely on historical performance information. This is the case when developing optimization plans for Use Cases such as special events

It’s important to differentiate between performance measurements (PMs) and performance indicators (PI/ KPI). PMs are triggered and collected at RAN Nodes when specific events occur (as an example the reception of a specific message from a UE, or the lack of reception of the same message when it’s expected to be received). KPIs are formulas that use PMs to determine network performance in specific areas (availability, accessibility, retainability, mobility, integrity, traffic, capacity utilization are examples of these areas). These formulas are usually recommended by OEMs and followed by operators with some minor modifications.

PMs (also known as Performance Counters) values are stored every Reporting Output Period (ROP) with a typical granularity of 15 min. Performance counters are then aggregated by performance reporting tools to generate aggregated information with different time scopes (daily, monthly, weekly) and different geographical scope (by city, province, region or network).

It’s recommended to the NaaS operator to use tools to automate the activities of collection and processing of the performance files, and if possible, automate also the real time detection of RAN performance degradations (i.e., deviations from established thresholds). Please refer to section 5.1.1 for more information on RAN performance tools.

4.1.1 KPI Targets

KPI Target tables are used to define the thresholds that will trigger optimization actions. These tables show target values at different levels of the network (cell. Node, BSC, RNC) and typically also show different criteria for different levels of aggregation.

Table 2 shows an example of KPIs that are grouped by Analysis Areas:

The table indicates reference threshold values to trigger optimization activities:

|

GROUP |

KPI |

Cell KPIs (based on BBH) |

Network KPIs (based on NBH) |

|

|

Threshold |

% of Cells |

|||

|

DCR Voice |

2G_DCR |

1.5% |

98% |

0,75% |

|

3G_DCR |

1.5% |

98% |

0,5% |

|

|

4G_DCR_CS (VoLTE) |

1.0% |

98.50% |

0,75% |

|

|

CSSR Voice |

2G_CSSR |

97% |

99.0% |

98% |

|

3G_CSSR_CS |

98% |

99.0% |

99,5% |

|

|

4G CSSR CS (VoLTE) |

||||

|

CSSR Data |

2G_CSSR_DATA (GPRS_CSSR) |

95% |

99.0% |

98% |

|

3G_CSSR_PS |

97% |

99% |

99,25% |

|

|

4G_CSSR_PS_Success_Rate |

||||

|

DCR Data |

3G_DCR_PS |

2% |

99% |

1% |

|

4G_DCR_PS |

||||

|

Paging |

CS Paging Success (2G/3G/4G) |

90% |

99% |

90% |

|

2G Data Paging Success |

99% |

90% |

||

|

3G Data Paging Success |

99% |

90% |

||

|

4G Data Paging Success |

99% |

|||

|

Mobility (HO) |

2G_HO_Success_Rate (Intra-GSM) |

95% |

98% |

98% |

|

HO_3G3G (SHO Speech) |

98% |

99% |

||

|

HO_3G3G (HHO Speech) |

98% |

|||

|

IRAT_HO_3G2G_speech |

||||

|

HO_2G3G_Speech |

97% |

|||

|

HO Preparation Success 4G/3G |

97% |

99% |

99% |

|

|

HO Execution Success 4G/3G |

98.5% |

98% |

||

|

4G: CSFB Succ Rate |

||||

|

4G: IntraLTE HO SuccRate |

98% |

99% |

99% |

|

|

4G: IntrafreqLTE VoLTE SuccRate |

||||

|

4G: InterfreqLTE VoLTE SuccRate |

||||

|

CSFB Attempts to 3G |

Analyze if daily variation > 50% |

|||

|

CSFB Attempts to 2G |

||||

|

Traffic Volume |

2G_Speech_minutes |

Analyze if daily variation > 25% |

||

|

3G_Speech_minutes |

||||

|

4G VoLTE Downlink Volume |

||||

|

4G VoLTE Uplink Volume |

||||

|

4G VoLTE_Speech_minutes |

||||

|

2G DL Data traffic (KB) |

Analyze if daily variation > 25% |

|||

|

2G UL Data traffic (KB) |

||||

|

3G DL Data traffic (MB) |

||||

|

3G UL Data traffic (MB) |

||||

|

4G_Downlink_Traffic_Volume_MB |

||||

|

4G_Uplink_Traffic_Volume_MB |

||||

|

Throughput |

Tput DL 2G EDGE |

Analyze if daily variation > 25% |

||

|

Tput UL 2G EDGE |

||||

|

User Throughput DL 3G |

||||

|

User Throughput UL 3G |

||||

|

Tput DL 4G |

||||

|

Tput UL 4G |

||||

|

Availability |

2G Availability |

97% |

99.5% |

98.0% |

|

3G Availability |

97% |

99.5% |

98.0% |

|

|

4G Availability |

98% |

99.5% |

98.0% |

|

|

Other |

RSSI 3G |

Analyze if daily variation > 3dB |

||

|

Interference 4G PUSCH UL (RSSI UL 4G) |

||||

|

4G_% MIMO |

Analyze if daily variation > 20% |

|||

|

4G_% Carrier Aggregation |

||||

Table 2. Key Performance Indicators – Thresholds for Optimization activities

The RAN KPIs template in Table 2 is included as part of this module including a Primer on RAN KPIs.

4.1.2 Top Offenders and Business KPIs

In addition to RAN KPIs, which are derived directly from performance counters, there are two additional types of KPIs that serve well to support the optimization engineers’ activities:

4.2 RAN Configuration

Radio Network Elements are configured via parameters which determine the way UEs interact with the network. These parameters will be able to control relevant features spanning from the accessibility to the network, the mobility and distribution of UEs among different NEs, power control and many others.

It’s critical for optimization activities to keep databases updated with configuration data so that the Optimization Process can rely on proper settings of the analyzed NEs. When performing RAN optimization, it’s important to be able to quickly correlate issues with possible configuration modifications or inconsistencies in the affected NEs.

Update periodicity of configuration management (CM) databases can be scheduled by the NaaS operator depending on known variability (how often is the network configuration being modified). As an example, it could be possible for an operator that 2G NEs configuration is stable enough to use monthly updates, whereas the refresh of the 4G configuration could need to be performed weekly or even daily.

Collection and processing of configuration data should be completely automated, as well as the detection of configuration inconsistencies.

Configuration information from NEs is typically accessible via text files (typically in xml formats). These files contain the settings of the parameters/attributes organized by logical objects (managed objects) that try to follow a hierarchical or functional structure.

4.2.1 Configuration Baseline

An approach to analyze RAN configuration consists in the definition of a set of Baseline Parameters. Reference to Baseline Configuration Parameters can also be found on the RAN low level design (LLD) module of the Runbook.

This group of parameters is set by the operator (usually following recommendations from Vendors and/or following feature tests performed by the operator) to settle values for parameters which drive main functionalities.

Integration of elements in the network needs to adhere completely to baseline values and/or ranges and optimization process/tools need to be able to check if there are NEs which are not following the recommended values. Since there are thousands of parameters, it’s important to be able to automate the process of detecting deviations from baseline values. Some SON solutions include modules for automated parameter inconsistency detection (and correction if SON is configured in a closed-loop mode).

Just as an example, Table 3 shows the baseline parameters set by an operator for the LTE discontinuous reception (DRX) functionality:

|

Parameter Topic |

Generic Parameter |

Vendor Parameter |

MO |

Standard Value |

|

DRX |

DRX Activation Switch |

DrxAlgSwitch |

Drx |

ON |

|

DRX Inactivity Timer |

DrxInactivityTimer |

DrxParaGroup |

PSF100 |

|

|

DRX Retransmission Timer |

DrxReTxTimer |

DrxParaGroup |

4 (SF8) |

|

|

DRX Short Cycle Timer |

DrxShortCycleTimer |

DrxParaGroup |

1 |

|

|

Use Spid Config |

DrxStatus |

SpidCfg |

TRUE |

|

|

Long DRX Cycle |

LongDrxCycle |

DrxParaGroup |

9 (SF320) |

|

|

On Duration Timer |

OnDurationTimer |

DrxParaGroup |

1 (PSF10) |

|

|

Short DRX Cycle |

ShortDrxCycle |

DrxParaGroup |

9 (SF80) |

|

|

Short DRX Switch |

ShortDrxSwitch |

Drx |

ON |

|

|

Enter DRX Switch |

EnterDrxSwitch |

DrxParaGroup |

ON |

Table 3. Baseline Parameters example for LTE DRX feature

Following the example above, baseline parameters should be structured in categories of parameters which are grouped by functionality. This approach allows a comprehensive analysis of the thousands of configuration parameters related to RAN elements.

4.3 Network Alarms / Faults

Analysis of the health status of any particular NE requires the detection of the faults/alarms and the notification to the Operations Systems (Equipment Management and/or Network Management Systems (NMS)). Therefore, lists of active alarms in the network as well as alarm historical data are relevant for troubleshooting activities.

Faults are usually grouped into the following categories:

NMS will provide interfaces to retrieve Fault Management (i.e., alarms) information from NEs and export functionalities if processing outside of the NMS was required. Protocols used in this interface to provide Fault Management information include:

4.4 Drive Test measurements

Despite the labor and cost intensive nature of drive test measurements campaigns, this optimization input still holds relevance especially in scenarios where associated commercial traffic is not yet significant enough in the network, as well as optimization for special environments. The related use cases may include:

Drive test measurements are characterized by logging of signaling messages in the radio interface. Its main drawback when compared to other available inputs is that the view that can be obtained only corresponds to the UE side.

Drive test activities are characterized by the usage of test engineering phones (and also additional radio receivers -i.e., scanners) and GPS to geo-locate the collected data. Data logging software on a laptop-PC is used to control this equipment.

As it’ll be further described in Section 5, there are several vendors who provide software solutions that can capture and decode messages in the radio interface (collection step). Usually solutions are proprietary in the way captured information is coded. Consequently, post-processing software solutions (post-processing step) are format-specific (although there are solutions being able to decode files from several vendors).

4.5 Call Trace

Call Trace functionality is usually utilized to log signaling messages and events corresponding to RAN Nodes (and their logical Cells), in a functionality which is known as cell traffic recording (CTR). Vendor implementations also usually allow the tracking and recording of messages corresponding to a single IMSI (in this case, the functionality is called user equipment traffic recording ‘ UETR).

Available call traces platforms (see section 5.1.5) will use the call traces files and will enrich them geolocating the position of the UEs by using the available network measurements (through techniques such as trilateration, fingerprinting and multilateration). Call traces can provide important insights into real subscriber experience and enhance the optimization process by correlating Call Trace Data with other optimization inputs, such as Performance or Fault Data.

Some specific applications of Call Trace Data include the following:

Call Trace Data consists of Layer 3 and other signaling protocols messages that are captured from the RNC (3G) and eNB (4G) protocols. Protocol layers at eNodeB or RNC that are decoded include RRC, S1AP and X2AP for 4G and RRC, NBAP, RANAP and RNSAP for 3G.

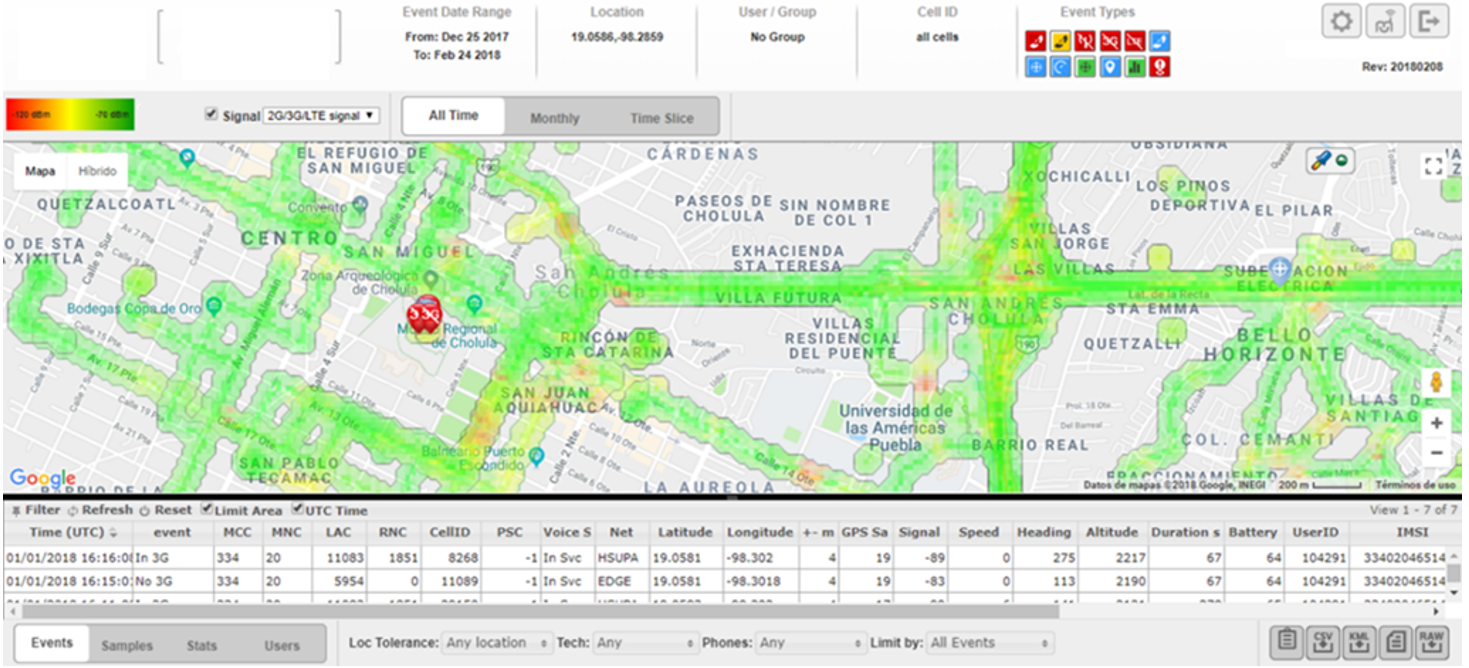

4.6 Crowdsourcing (Mobile Agents)

Passive Data collection from mobile apps can generate customers’ experience information in a 24×7 timeframe. This passive optimization input does not require any interaction from the end-user and works with very little additional battery consumption (used to send measurement results to a centralized backend). Moreover, most crowdsourcing solution providers claim as an advantage that this backend transfer process is triggered when the UE enters into a Wi-Fi area, limiting the required user traffic consumption. Nevertheless, it’s required from the user to accept terms when installing an app in his smartphone that will be transferring data to the crowdsourcing solution.

Collected data includes valuable information like the following:

Some of the tools available in the market allow gathering crowdsourcing data from diverse sources and add an analysis layer to perform engineering functions which are valuable insights for Optimization Use Cases:

Figure 5 shows an example of application layer that uses crowdsourcing data to provide the above-mentioned optimization inputs:

Figure 5. Crowdsourcing application user interface

4.7 Network Interfaces Probes

As reviewed in previous sections, there are optimization inputs/sources that focus mostly on the network radio interface. Although most RAN optimization activities are centered in issues found in this interface, it cannot be neglected that having a synchronized view of information in other network interfaces will allow to detect unusual patterns that could explain problems not detected at the radio interface level.

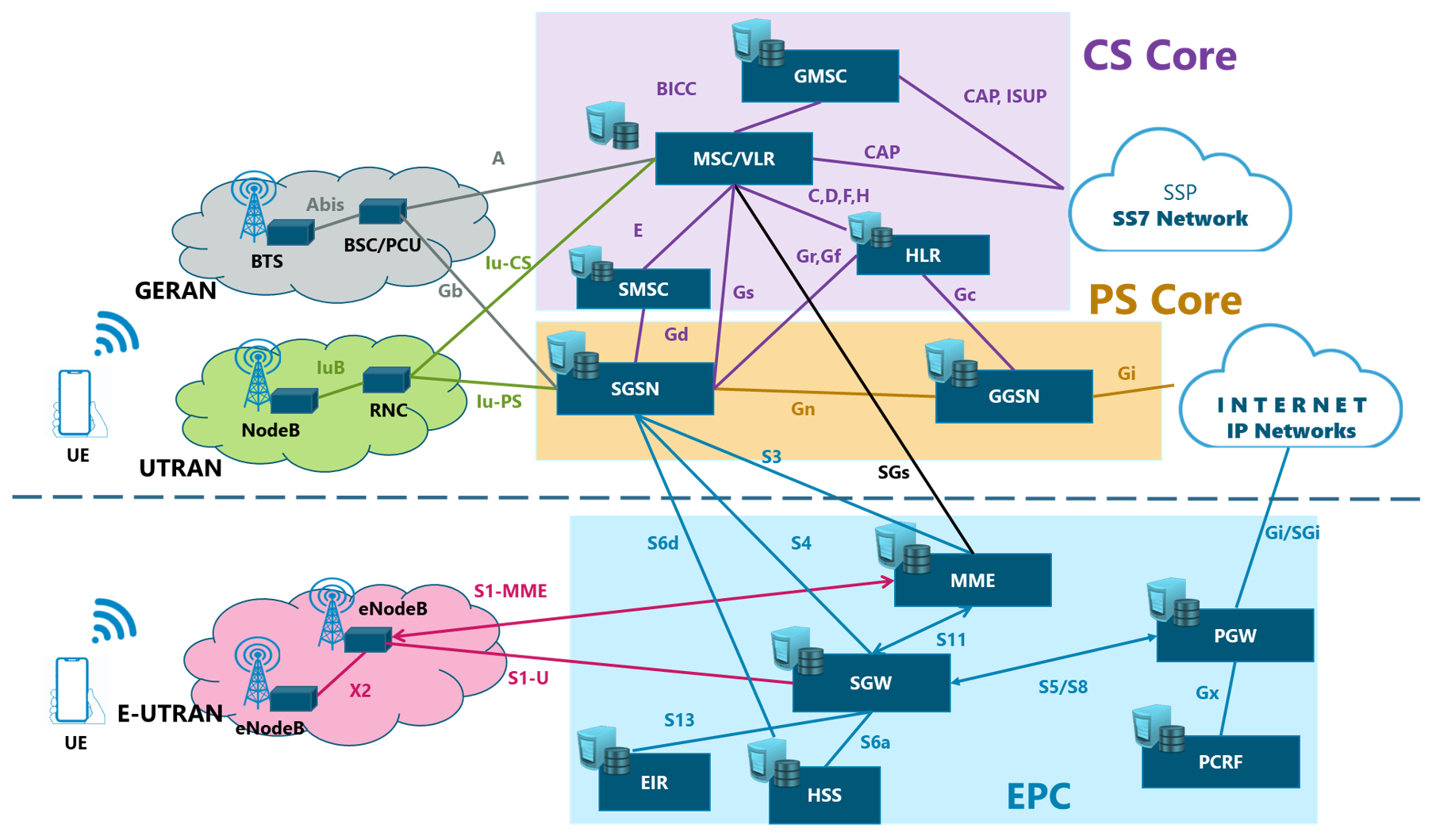

Figure 6 illustrates the main interfaces in 2G, 3G and 4G networks:

Figure 6. 2G/3G/4G Network Interfaces

To obtain measurements from these interfaces, special hardware from the monitoring probes connects to all sorts of network interfaces, from E1 to Multi-Gigabit interfaces, and it also ensures high-precision time stamping (please review Network Monitoring Architecture Module for additional information). These connections are passive (non-intrusive) and can capture all control and data planes’ traffic. Available platforms in the market allow storing and preprocessing this information and have functions such as: create signaling statistics, session and call-data records, allow run real time call tracing based on the collected data and enable post-processing for further investigations.

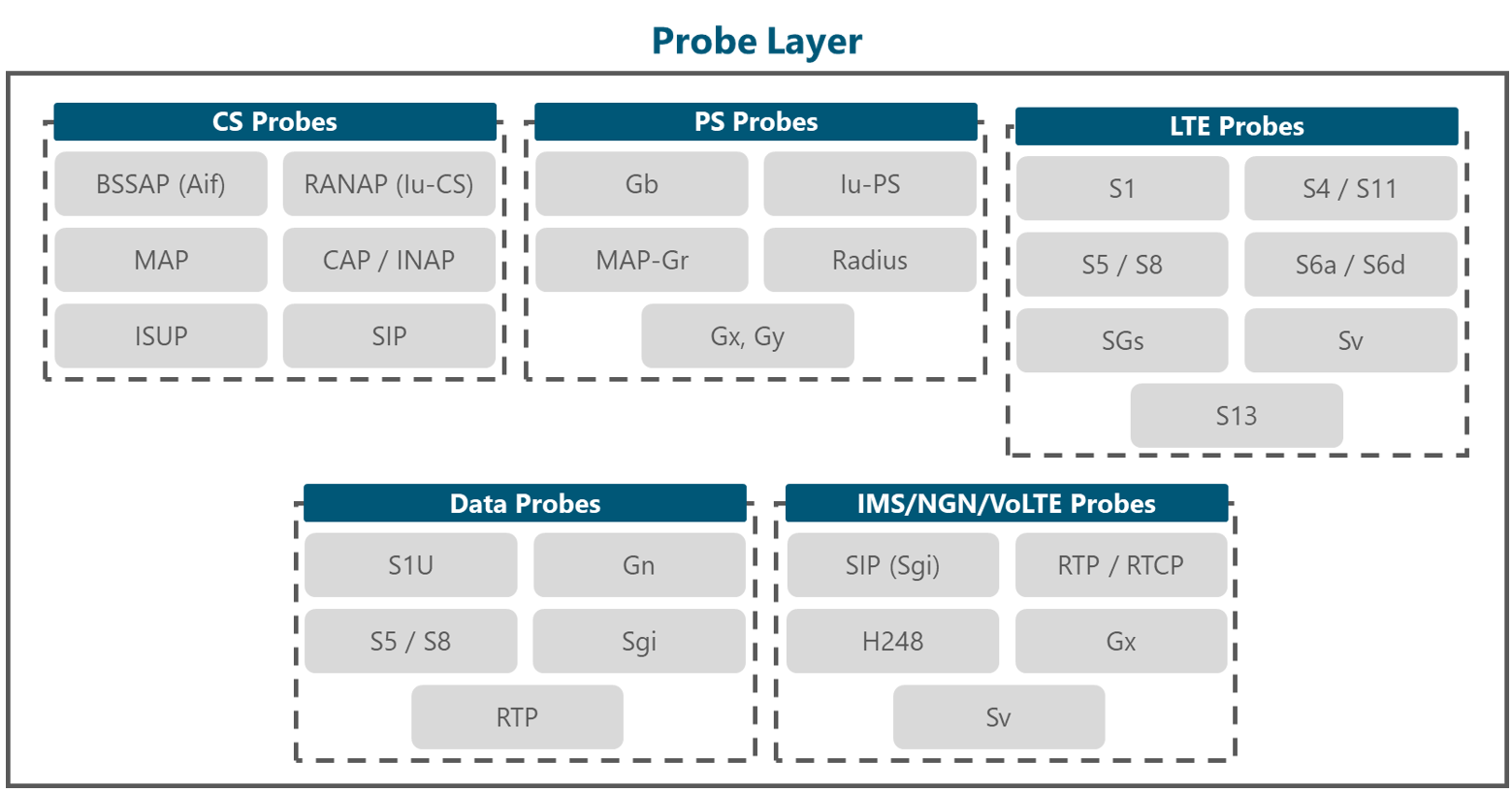

Figure 7 shows available Probe systems handling the indicated most relevant network interfaces:

Figure 7. NW Interfaces handled by Probe systems

Just as an example, if we think of initiating an LTE data session, it’ll be required to establish an Evolved Packet Switched (EPS) system bearer which will involve exchanging of signaling messages between core NEs such as MME, S-GW and P-GW (interfaces S1, S11, S5, SGi):

Figure 8. Example of interfaces in LTE bearer setup

Being able to obtain and synchronize messaging in these interfaces with the messaging in the radio interface will provide capabilities for E2E call tracing that will be required to optimize complex signaling situations.

4.8 Physical Inventory / Topology

Physical Inventory comprises sets of data which are not usually stored in the NEs management systems. When performing optimization activities, it’s important to have accessibility to databases that contain data like the following:

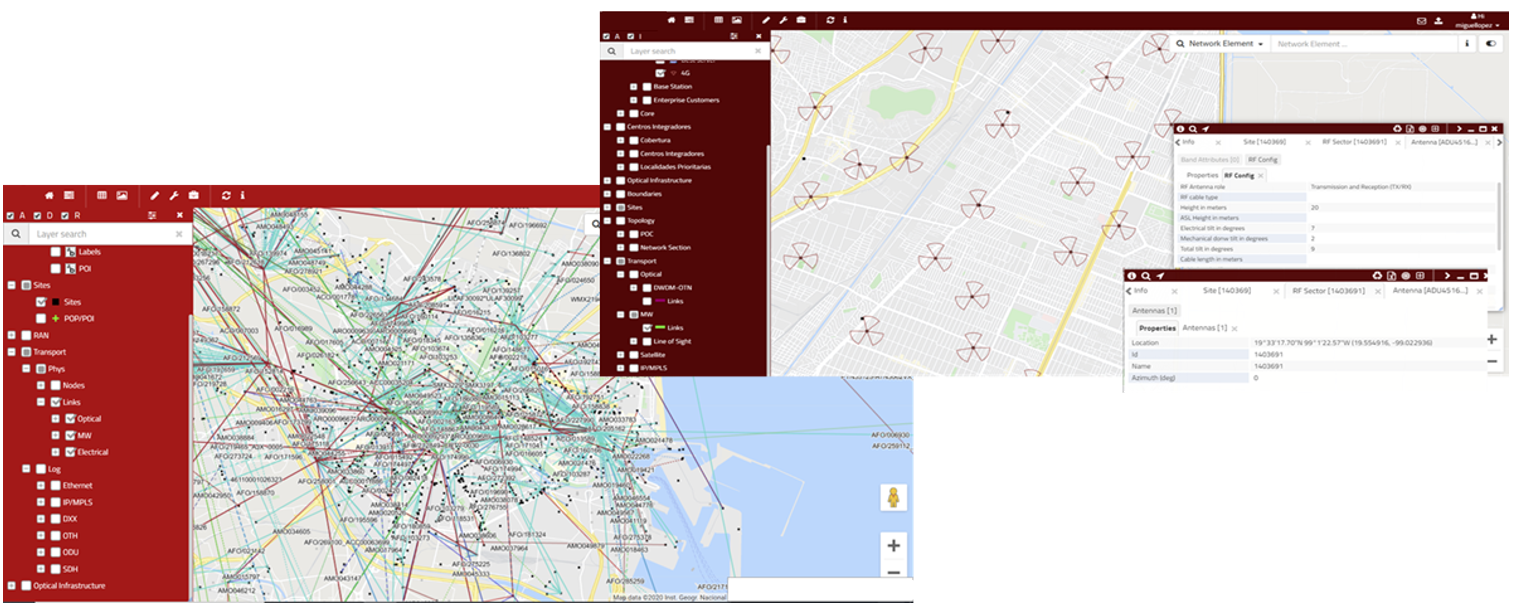

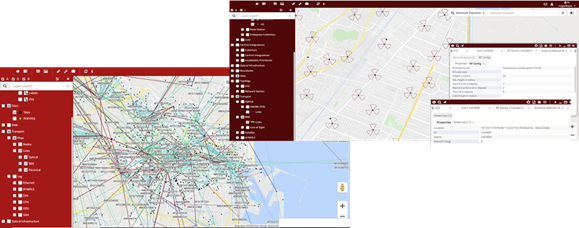

The following snapshots correspond to inventory tools which collect information about Physical Inventory:

‘

Figure 9. RAN Inventory data and tool UI

Figure 10. Backhaul Inventory data and tool UI

This geolocated information allows to frame optimization activities to the network regions where problems are identified

4.9 RAN Planning data

Mobile networks require a planning process before becoming commercial. This planning process applies not only to greenfield operators, but also to the introduction of new NEs/RAN Nodes and new technologies and/or services in existing operators.

Radio planning activities include determining proper locations for RAN Nodes to provide sufficient coverage (i.e., signal level required for each provided service). These activities rely on software tools which contain propagation models to predict the coverage area of each transmitter/receiver used in the mobile network.

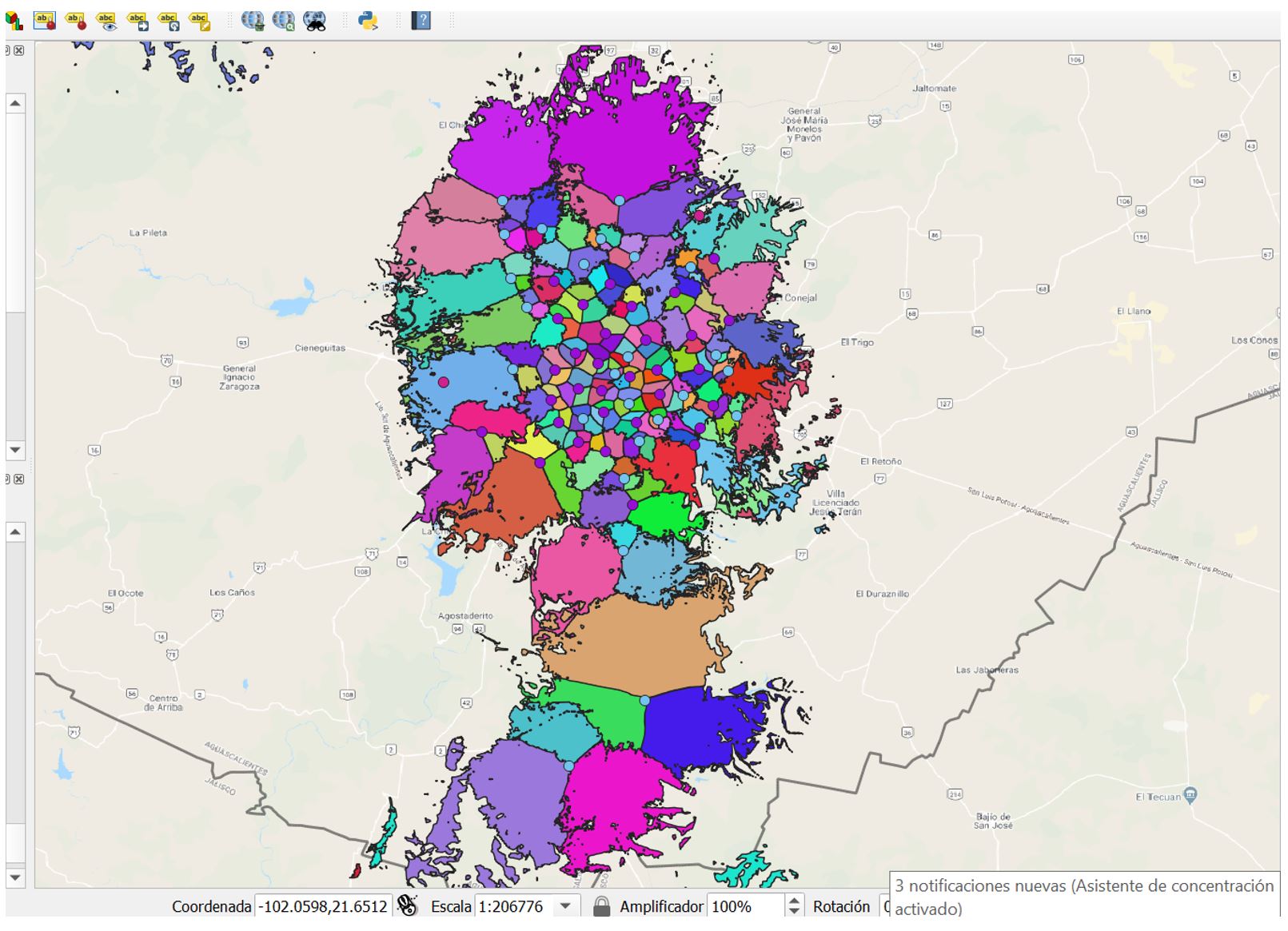

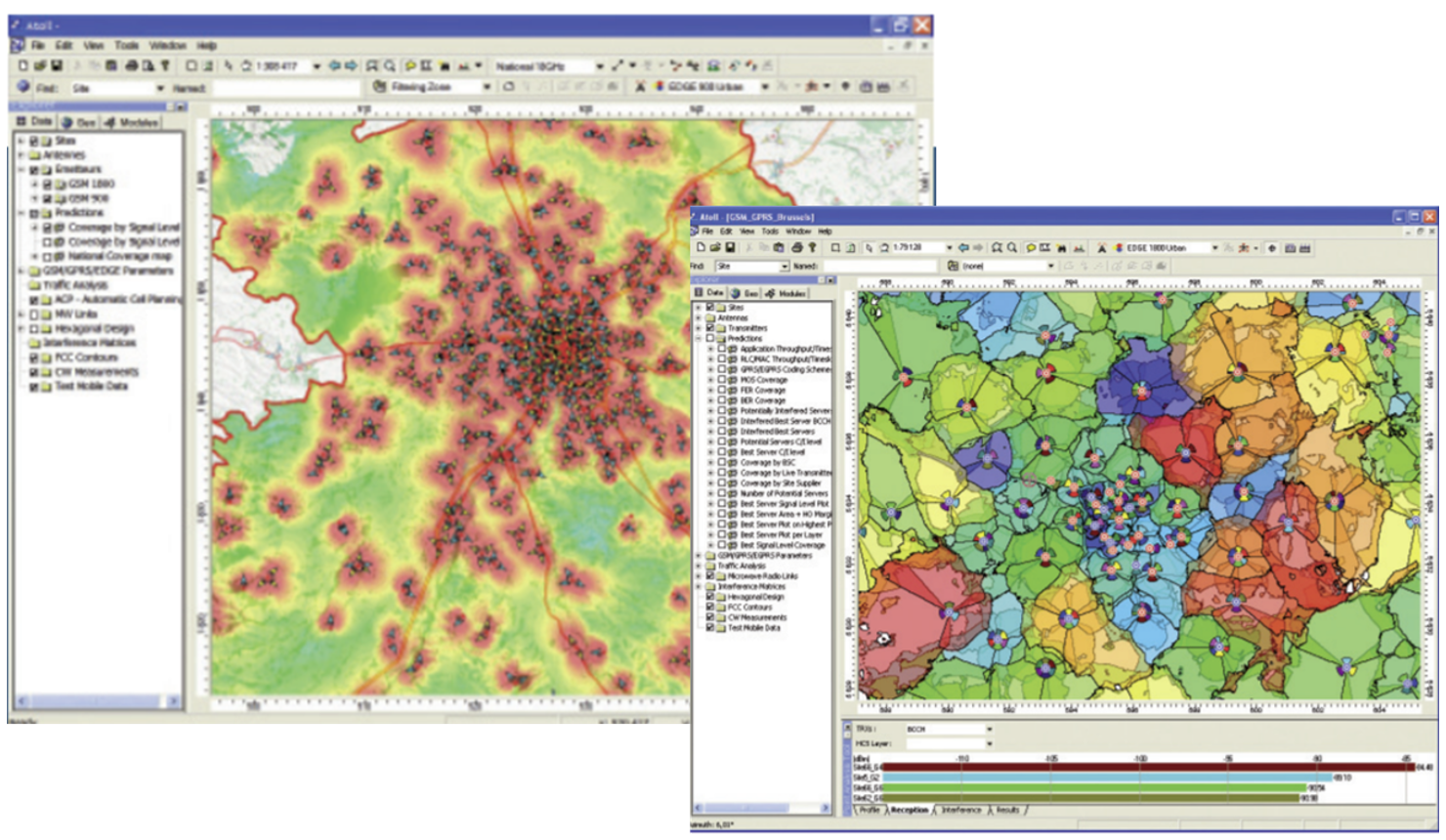

As an example, the following illustration shows an example of best server plot, indicating the areas where each specific transmitter provides a better communication link):

Figure 11. RAN Planning data

During optimization activities, it could be required to check in specific problematic areas that the transmitter that in the real network is providing the communication link matches with the planned transmitter.

Unmatching situations could reveal issues going from generic problems with the planning of the network to more specific issues such as crossed sectors, overshooting cells and missing neighbors.

For this purpose, it’s important to be able to provide planning inputs to the optimization process to geographically correlate that the planned server in the problematic area matches the one provided by other optimization sources (e.g., drive tests, crowdsourcing)

5 Optimization Process and Tools

Previous sections have been focused on the description of triggers for RAN optimization activities (i.e., optimization use cases) and the description of most common data sources used to perform these optimization activities.

This section addresses the RAN optimization day-to-day activities, the generic optimization process for all those activities and the set of tools to support the optimization team.

5.1 RAN Optimization Organization

RAN optimization activities are usually performed by resources in the engineering team of the NaaS operator, supported to some extent by network operations center (NOC)/security operations center (SOC) and field maintenance personnel. Even when the network is stable and there are no special projects (see use cases in section 3), optimization engineers will have the following responsibilities on a daily basis:

The ongoing monitoring activities of the RAN are supported by the NOC, while field interventions and required physical changes are executed by field maintenance technicians. These resources are sized following guidelines in the corresponding module of the NaaS playbook.

Finally, dimensioning of the optimization engineering resources will vary based on the available tools and size of the network. One simple approximation is to consider one optimization engineer per 250 sites.

Special projects may need to devote more resources or outsource optimization services to cope with surges in optimization work coming from use cases such as special events preparation, and technology evolution.

5.2 Optimization Process

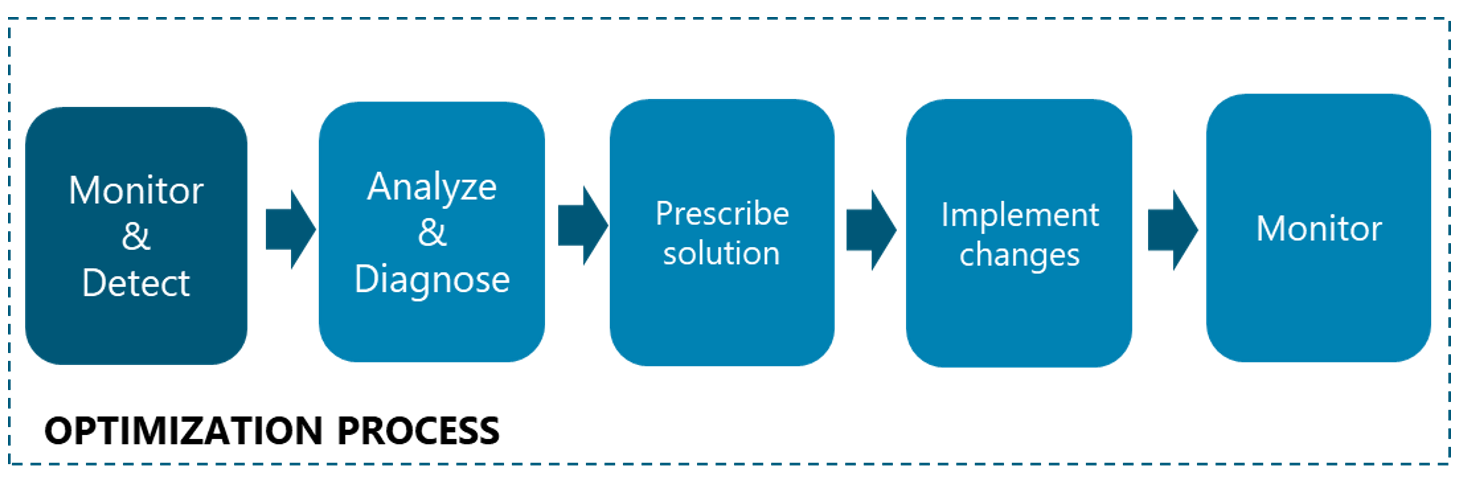

As presented in the section above, there is a set of activities performed by the optimization team. Independent of the specific activity and use case, the optimization process will be the same. The objective of this section is to provide the NaaS operator with a description of the tasks included in the Optimization Process, which is represented in Figure 12:

Figure 12. Optimization Process tasks

Monitoring

The RAN Optimization team of the NaaS operator will be responsible for monitoring the network performance and the quality perceived by the customers. This will be achieved by monitoring and analyzing the RAN performance KPIs, allowing the detection of the NEs (nodes, cells) which have a negative impact in the network performance and in the customer perception. This is an on-going process composed of an ‘offline’ and an ‘online’ component. In the ‘offline’ monitoring, RAN Engineers will usually review and troubleshoot the tes from the previous day(s). These ‘offline’ activities will be complemented by an ‘online’ monitoring, where the NOC of the NaaS operator will continuously monitor the status of the Nodes (i.e., absence of alarms affecting the provided service). The monitoring of the NOC should work on a 24×7 approach (please refer to NOC module for additional information on NOC activities).

To achieve the monitoring task, NaaS operator will need to deploy procedures and tools to integrate and track the sources of information that provide insights of network performance, and that mainly are:

Required procedures and tools will have enough flexibility to allow the aggregation / disaggregation of the KPIs from upper to lower network and geographical entities (RNC / BSC / Node / Cell; Network-wide / Region / Province,’).

Detection

RAN optimization team will be responsible for the detection of the network performance degradations that impact the quality of services perceived by the customers or the system performance.

The activity will consist of searching for poor performing NEs revealed by the inspection of the different metrics available.

To implement the detection task, the NaaS operator will establish decision rules that will be applied to the monitoring results for triggering any degradation affecting the quality. Degradations with respect to normal performance will include dropped calls, relevant decrease in accessibility, availability, traffic volumes, data throughput traffic balance, etc.

When required, it’ll be necessary to activate and manage the needed operational and / or maintenance network processes to solve the fault or degradation (open tickets to NOC with specified format and diagnosis done, with and specified service-level agreement (SLA) to solve in case of service affecting incidents) (please refer to NOC module for additional information on NOC activities).

Analysis and Diagnose

This activity includes the problem definition and the impact assessment (when / where / how much / ‘) as well as the Root Cause Identification and its nature (Network Configuration; Lack of coverage; RF planning related; Parameter settings related; Capacity related; Transmission issues; ‘)

The analysis and diagnosis of detected RAN performance issues will consider the use of the different optimization data sources as described in section 4.

The following data inputs will be the main ones to be used to troubleshoot detected issues:

More complex troubleshooting could require the utilization of additional data inputs to solve issues. These data sources could include:

Prescribe and implement solution

Define the solution plan and manage the implementation by using the appropriate procedures available, depending on the nature of the action.

It’s possible that the action plan needs to be executed by other teams using the inputs generated: maintenance issues; malfunctioning HW / SW to be fixed / replaced; recommendations to deploy additional capacity or coverage.

Monitor

Verify that the problem has been solved after implementation.

5.3 Optimization Tools

This section introduces commercial tools that are specialized in the processing and analysis of specific optimization inputs.

Table 4 lists some examples of tools tailored to process the specific data inputs described in the previous section:

Table 4. RAN Optimization Tools

The following sections provide a brief description of some representative tools for each category above.

5.3.1 RAN Performance

Tool: Mycom PrOptima

Link: https://www.mycom-osi.com/products/proptima/service-and-network-performance-management

MyCom PrOptima provides a unified PM platform to store, visualize and analyze RAN performance.

Beside RAN, it’s also used for E2E PM including support for multiple network domains, technologies, and network equipment vendors.

Main features include:

‘

Figure 13. Mycom PrOptima: Performance Management Tool

5.3.2 RAN Configuration Management

Tool: TEOCO SmartCM

Link: https://www.teoco.com/products-services/ran-solutions/configuration-management/

SmartCM maintains network integrity by automating the monitoring, auditing, updating, and reporting on network configuration.

SmartCM allows engineers to monitor and improve network quality by providing visibility to the live network configuration and comparing it against a desired network baseline. This highlights configuration discrepancies ‘ a primary cause of poor network performance.

Main features:

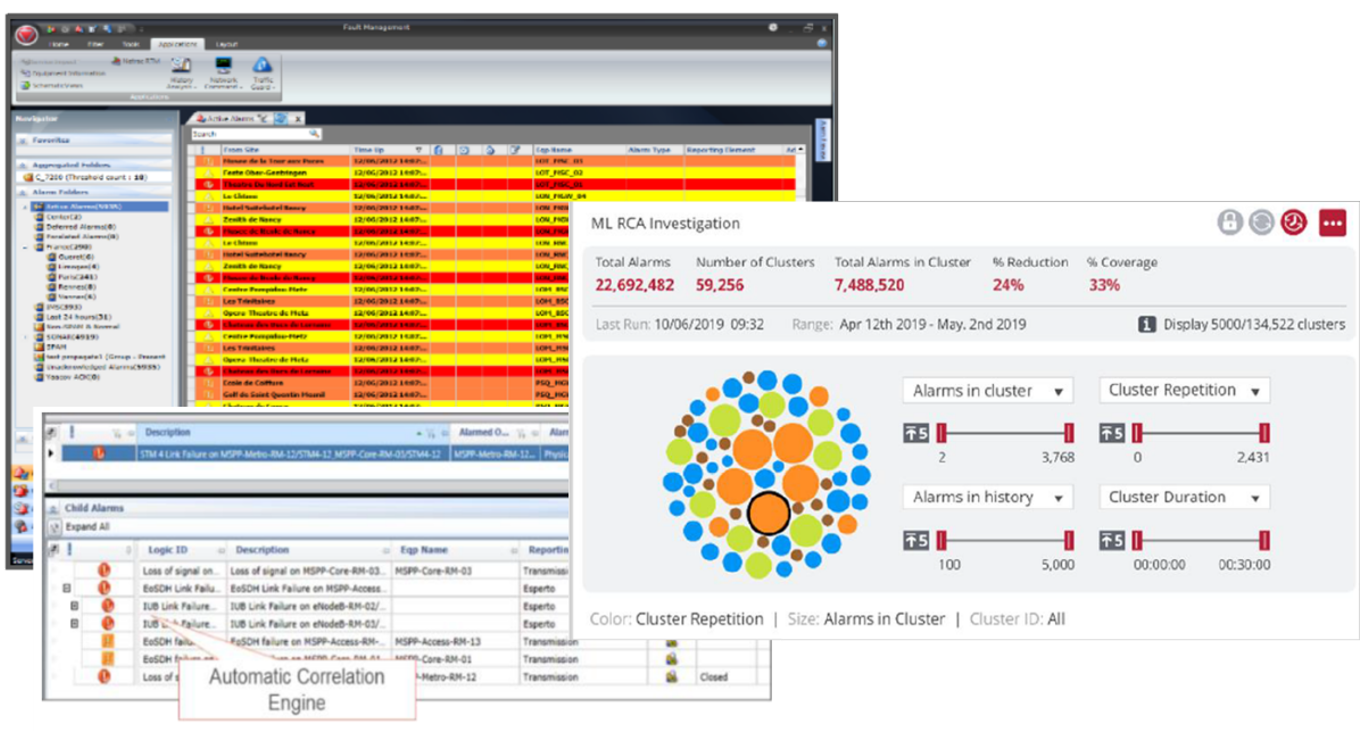

5.3.3 RAN Fault Management

With respect to Fault Management, it’s important to note that RAN Equipment Vendors offer as part of their product, solutions to manage their proprietary NEs (NMS). These Network Management Systems are able to detect and report faults.

Some examples of these RAN Vendor solutions include the following:

On top of these Vendor proprietary NMS there are solutions that are able to work with Alarms information from different Vendors (unified system benefit) in addition to incorporate features for filtering, correlation, notification, etc.

Tool: TEOCO Helix Fault Management

Link: https://www.teoco.com/products-services/service-assurance/fault-management/

Helix Fault Management (FM) is a centralized system for the management of faults and alarms in complex carrier networks.

Helix FM is an E2E solution for managing network events: collecting event data, receiving alerts, creating trouble tickets, diagnosing, and investigating network issues, analyzing network events, correlating faults, and automating their resolution. Helix FM accompanies your NOC experts throughout the entire fault management process to simplify the oversight of the network’s health.

Main features include:

Figure 14. TEOCO Helix FM: Alarms / Fault Management tool

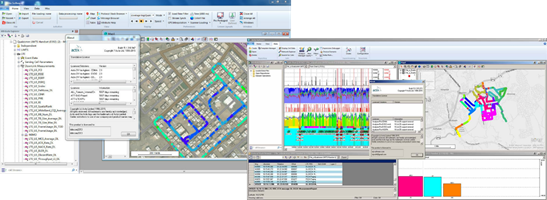

5.3.4 Drive Test analysis

Tool: Amdocs Actix Analyzer

Link: https://actix.com/analyzer/

ActiX Analyzer is a desktop solution for drive test post-processing.

Main capabilities include:

Figure 15. Amdocs Actix Analyzer: Drive Test Analysis tools

5.3.5 Call Trace Analysis

Tool: EXFO Nova GEO

Link: https://www.exfo.com/en/products/service-assurance/real-time-analytics/nova-geo/

EXFO analyzes multivendor, multitechnology radio in real time from call traces generated by network equipment (BTS, nodeB and eNodeB) for every call and data session from any subscribers anywhere on the mobile network. These rich call traces provide detailed information, including radio measurements and radio and network equipment behavior.

The combination of call traces and probe data (RAN + core) provides unique information about E2E geolocated QoE and usage for voice as well as data services. It’s important to note that geolocation technologies may not have the expected accuracy in rural environments. Thus, a careful assessment of this feature should be performed.

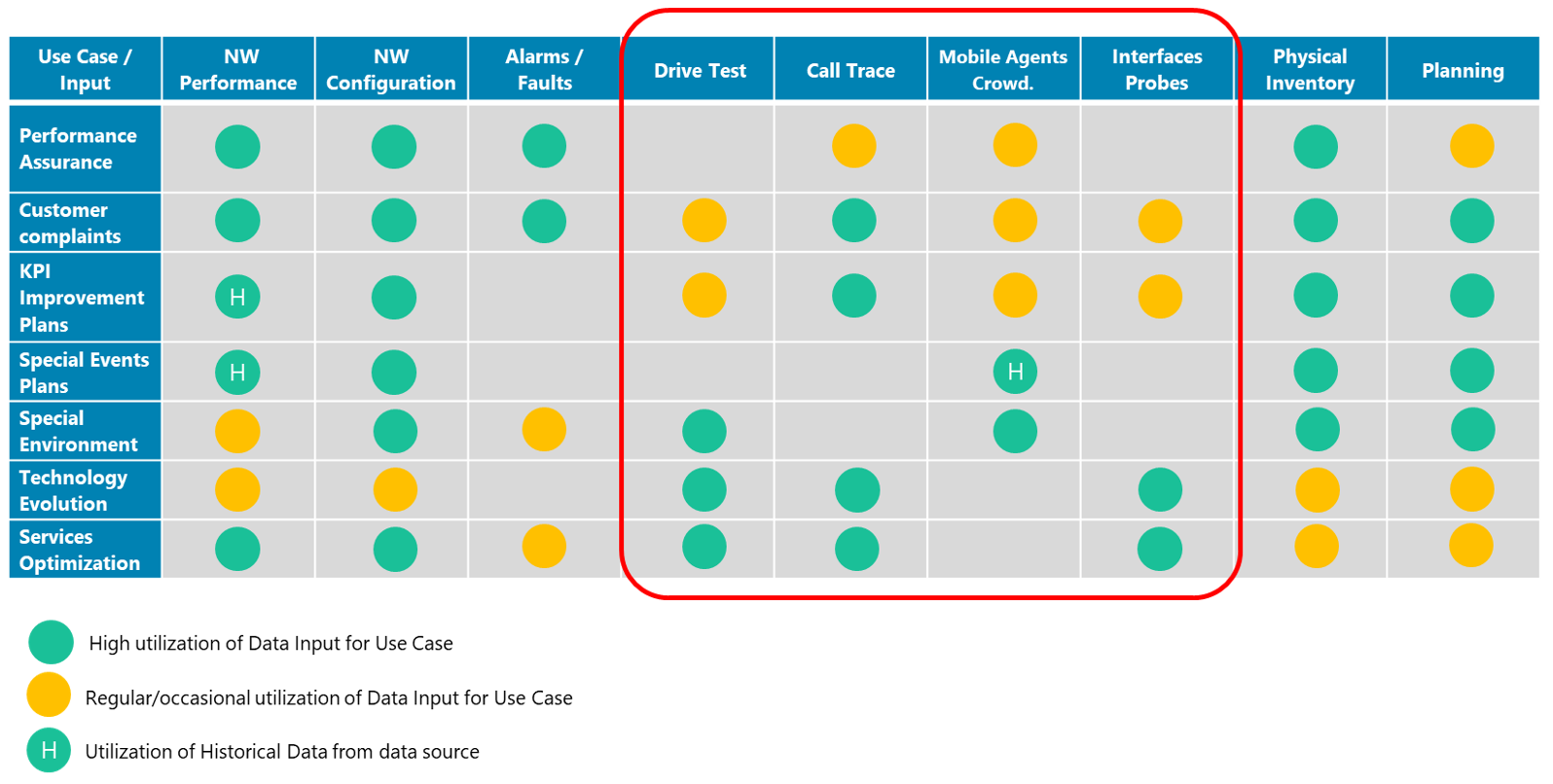

EXFO NOVA suite of tools allows correlation of different data sources, being the call trace data one of the main inputs:

Figure’16. EXFO Nova suite

NovaGEO is a radio optimization tool that measures RF coverage and network quality. It facilitates daily radio optimization tasks by automating recurrent analysis and drastically reduces the number of drive tests.

It’s a fully virtualized solution that supports advanced geolocation techniques such as trilateration, fingerprinting and multilateration, thereby guaranteeing first-rate accuracy in locating devices across multitechnology networks (2G/3G/4G/LPWAN).

Main features include the following:

NovaGEO can be combined with other EXFO platform tools like Nova Explorer for E2E in-depth troubleshooting:

Figure 17. EXFO Nova Geo: Call trace Analysis

5.3.6 Crowdsourcing Analysis

Tool: Tutela Explorer

Link: https://www.tutela.com/explorer

Tutela is a mobile data and analytics company that crowdsourcesanonymous device, network, and application data from millions of end-user mobile devices around the world. Tutela collects data that helps the mobile and telecommunicationsindustry understand user and device quality of service (QoS) and usage patterns. This gives operators the information they need tooptimize their networks, products, and services, and improve customer experience.

Main features of Tutela Explorer includes:

Figure 18. Tutela Explorer: Crowdsourcing analysis

5.3.7 Interfaces Probes Data Analysis

Tool: Empirix Diagnostix and Holistix Applications

Link: https://www.empirix.com/products/diagnostix/

Diagnostix is a set of applications designed to help operations teams quickly identify service-impacting issues and their true root cause across networks, services, devices, and applications. It provides granular insight into call and data sessions to provide an accurate view of network performance and customer experience.

Main features include:

Figure 19. Empirix Probes Data analysis

5.3.8 Physical Inventory / Topology

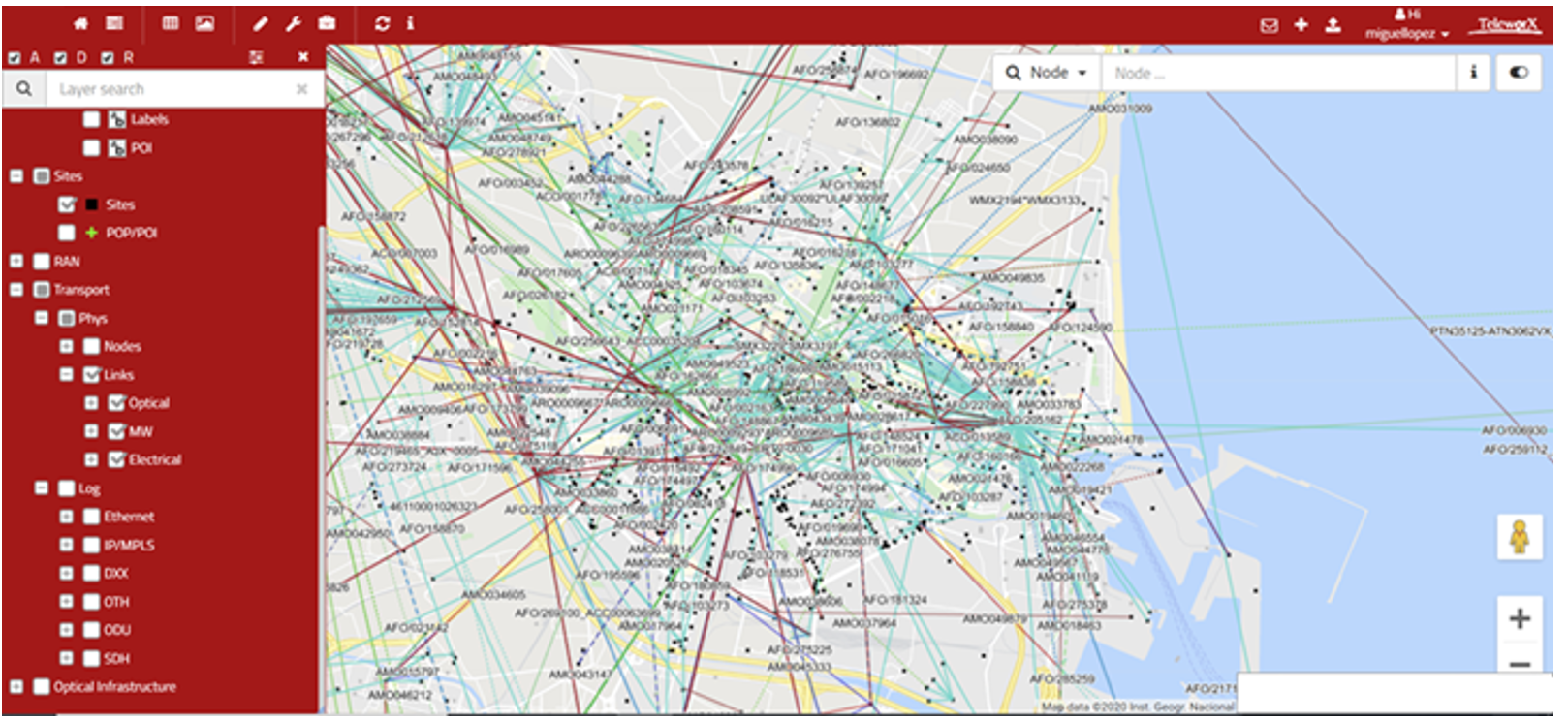

Tool: TeleworX mapvista

Link: https://www.teleworx.com/products.html#features11-24

MapVista integrates a versatile network model inventory with the power of geographic analysis to provide a truly integrated E2E network planning capability. It integrates workflow and document management modules to facilitate integration with existing corporate systems.

mapVista main functionalities include:

Figure 20. TeleworX mapVista NW Inventory

5.3.9 RAN Planning

Tool: Forsk Atoll

Link: https://www.forsk.com/atoll-overview

Atoll provides operators and vendors with a powerful and unique framework for designing and optimizing indoor & outdoor RAN.

Atoll is a multi-technology wireless network design and optimization platform that supports wireless operators throughout the network lifecycle, from initial design to densification and optimization.

Main Atoll functionalities include the following:

Figure 21. Forsk Atoll RAN Planning

5.4 Self-Organizing Networks (SON)

SON are automation technologies oriented to facilitate the efforts of planning, configuration, and optimization in the Mobile Operators, reducing the OPEX required to manage complex networks with multiple technologies and frequency bands. SON functions can help NaaS operators to reduce OPEX by reducing manual involvement in these processes (planning, configuration, and optimization).

SON architectures can be categorized in the following depending on the entity which executes the SON algorithms:

The following table shows some differences between the solutions:

|

D-SON |

C-SON |

H-SON |

|

Implemented into NEs (eNB, RNC) |

Implemented into central managing Server. |

Leverages advantages of D-SON and C-SON |

|

Vendor dependent solution |

Vendor independent |

|

|

Shorter response cycle |

Higher response cycle |

Table 5. SON architectures

In the area of Self-Optimization, current status can be summarized by algorithms in the following areas:

Current SON implementations work with interfaces providing the following OSS data sources:

Table 6 shows Use Cases and their objectives implemented in commercial SON solutions. Typically, these solutions include algorithms for the different technologies in the network (2G, 3G, 4G):

|

Use Cases |

Objective |

|

Coverage and Capacity Optimization |

Provide Optimal Coverage and Capacity |

|

Energy Saving |

Switching off a cell when its capacity is no longer needed and reactivate again on a need basis |

|

Interference Reduction |

Interference reduction based on cell switch on/off to increase capacity and QoS |

|

Automated Configuration of Physical Cell Identity |

Automatic configuration of the Physical ID of an eNB’s radio cell (4G) |

|

Mobility robustness optimization |

Detection of Too Late Hand Over (HO) Detection of Too Early HO Detection of HO to a Wrong Cell Reducing inefficient use of network resources due to unnecessary HO Optimization of cell reselection parameters |

|

Mobility Load balancing optimization |

Self-optimization of the intra-LTE and inter-RAT mobility parameters according to the current load in the cell and in the adjacent cells to improve the system capacity |

|

RACH Optimization |

Minimize access delays for all UEs in the system Minimize UL interference due to RACH Minimize interference among RACH attempts |

|

Automatic Neighbor Relation Function |

Build and maintain neighbor relation |

|

Inter-cell Interference Coordination |

Control parameters of radio resource management (RRM), inter cell interference cancellation (ICIC ) schemes for UL and DL |

Table 6. SON Use Cases

Usage of C-SON solutions for NW Performance Assurance requires significant efforts to effectively manage different vendors’ equipment in the network. This is important to apply the same optimization procedures in a network-wide scenario without differences between RAN vendor areas. SON automated modules need to be applied in closed-loop mode for them to automatically implement the changes in the NEs.

5.5 NaaS Operator Data and Tools usability guide

Previous sections have provided the NaaS operator (and more specifically, the RAN optimization teams in the NaaS operator), with a comprehensive overview of the extensive list of available data sources and corresponding tools to support RAN optimization activities.

Considering that the typical environment in which NaaS operators will perform their activities are characterized by providing coverage to rural and to some extent isolated areas, the present section is intended to provide NaaS operator with an initial view or guide to highlight the sources and tools to be used in a ‘Basic Scenario’ and the sources and tools to be used in a more ‘Advanced Scenario’. Figure 21 captures this approach:

Figure 22. NaaS operator data and tools scenarios

Under this approach, the RAN optimization teams in the NaaS operator should be equipped in a Basic Scenario with tools allowing them to get access to the following information:

It’s being assumed that the NaaS operator will have access to a RF Planning Tool used to determine and simulate the propagation of the RAN sites.

From this planning tool and/or from an independent Physical Inventory database, RAN optimization engineers would have access to site information including Sites position and antenna configuration: number of sectors, antenna heights, azimuths, tilts.

This information, properly geolocated, will be crucial for the optimization process activities.

RAN equipment vendors provide proprietary tools to manage the provided NEs. Their Network Management tools provide access to the vendor NEs and are capable to retrieve:

Different scenarios are possible for the optimization teams to get access to these NW Data sources, from direct access to the Management Systems by using Northbound Interfaces (NBI) that will export this information that will be afterwards processed by the tools described in the present document.

These two groups of data sources and corresponding tools are considered a basic requirement for the optimization activities, and would be required for most of the use cases described in section 3.

Resolution of complex optimization problems (that could be associated to complex scenarios with high density of macro-cells and small cells, multiple radio access technologies and frequency bands, and complex transmission topologies) may require the use of ‘advanced’ optimization data sources and tools, including Call Traces and Interfaces probes, crowdsourcing data, and drive test (probably to a lesser extent for Rural NaaS operators with difficult access to site locations).

As already introduced in section 4, some of these ‘advanced’ data sources can provide good optimization insights for the analysis of complex optimization issues of the different Use Cases, as illustrated in Figure 22:

Figure 23. Advanced data sources and Use Cases

As described in the following paragraphs, these ‘advanced’ data sources will provide meaningful insights to the optimization team in specific Use Cases:

It’s important to note that the Basic NW Data sources (PM, FM, CM) will provide information down to the cell granularity level. Since it’s not possible to distinguish the specific performance in the specific locations of these special environments.

To do that, other data sources such as drive tests and crowdsourcing, thanks to the precise location information associated with these data sources, can provide meaningful insights to the optimization teams.

Deployment in the network of new features or new technologies are usually tested by the operators in controlled geographical environments formed by a reduced cluster of sites.

Optimization teams may require in these cases access to decoded messaging in the different network interfaces. To do that, it’ll be required to use advanced tools to process air interface messaging (captured through drive test), as well as information provided through call trace and interface probes.

In a very similar way to the Technology Evolution Use Case, introduction of new services (VoLTE as an example) in the network may be tested in controlled environments for Optimization teams to find proper configuration settings. Similarly, usage of advanced data sources and tools will provide the required insights to attend these Use Cases.

4.1 RAN Performance

4.2 RAN Configuration

4.3 Network Alarms / Faults

4.4 Drive Test measurements

4.5 Call Trace

4.6 Crowdsourcing (Mobile Agents)

4.7 Network Interfaces Probes

4.8 Physical Inventory / Topology

4.9 RAN Planning data

5. OPTIMIZATION PROCESS AND TOOLS

5.1 RAN Optimization Organization

5.2 Optimization Process

5.3 Optimization Tools

5.4 Self-Organizing Networks (SON)

5.5 NaaS Operator Data and Tools usability guide